Insurance Underwriter Average Salary in USA, 2026

Insurance Underwriter salaries in the United States represent a critical function within the financial and risk management sector. As of 2026, what is the earning potential for professionals who assess risk and determine policy terms? How much can you expect to make, and what factors cause such a wide range from entry-level to experienced roles? This comprehensive analysis breaks down the national average, state-by-state variations, and the key factors influencing pay. Understanding these figures is essential for both aspiring underwriters and seasoned professionals navigating their career trajectory in a dynamic insurance landscape.

What Is the National Average Salary for an Insurance Underwriter in 2026?

Why is there such a broad salary range for underwriters, and where does the typical professional stand? Based on aggregated data from 2026, the average annual salary for an Insurance Underwriter in the United States is $81,250. This translates to an hourly wage of approximately $41.12. How many professionals fall into the entry-level bracket? Positions start around $48,113 per year, which is common for those with less than two years of experience. On the other end of the spectrum, most experienced workers with specialized knowledge or in managerial roles can earn up to $116,500 annually. The median salary, a crucial metric that represents the midpoint, is also $81,250, indicating a relatively balanced distribution around this figure. This range highlights the significant impact of experience, specialization, and geographic location on earning potential.

How Does Insurance Underwriter Salary Vary by State?

Where you work is one of the most significant determinants of your salary. What is the difference between the highest-paying and lowest-paying states? The variance can exceed $45,000 annually, influenced by local industry hubs, cost of living, and market demand.

Top-Paying States (2026 Data):

-

Massachusetts & Connecticut: Tied for the lead at $90,000 annually, driven by dense concentrations of insurance and financial services companies.

-

New York: Close behind at $89,903, benefiting from the major financial center of New York City.

-

New Jersey: $82,261, influenced by its proximity to New York and a strong corporate presence.

-

Idaho & West Virginia: Reported averages of $80,000 and $78,000 respectively, which may reflect niche markets or a lower number of highly specialized roles commanding higher pay.

Lower-Paying States (2026 Data):

-

Montana: $44,252

-

Kentucky: $45,760

-

Hawaii & Indiana: $47,500 and $48,750 respectively.

How can you use this information? If geographic flexibility is an option, targeting roles in the Northeast can be financially advantageous. However, remote work opportunities in 2026 are increasingly allowing professionals in lower-cost states to work for companies based in high-paying regions.

What Are the Key Factors That Influence an Underwriter’s Salary?

Beyond location, several key factors dictate earning power. Which factors carry the most weight?

-

Experience: This is the primary driver. Entry-level (<2 years) underwriters handle routine assessments, while senior underwriters (5+ years) manage complex portfolios, mentor juniors, and make high-stakes decisions.

-

Specialization (Line of Business): What is the difference between a commercial lines underwriter and a personal lines underwriter? Commercial underwriters, dealing with business insurance, often earn more ($83,750 average) due to the complexity and higher policy values compared to personal lines ($71,463). Specialized areas like Property Underwriting ($85,763) or roles in excess & surplus (E&S) lines can command premiums.

-

Education and Designations: A bachelor’s degree is standard, but professional designations like CPCU (Chartered Property Casualty Underwriter), AU (Associate in Commercial Underwriting), or ARM (Associate in Risk Management) significantly boost credibility and salary.

-

Company Size and Type: Large national carriers or prestigious Lloyd’s of London syndicates typically offer higher base salaries and bonuses compared to regional agencies or smaller firms.

What Is the Career Path and Salary Progression for an Underwriter?

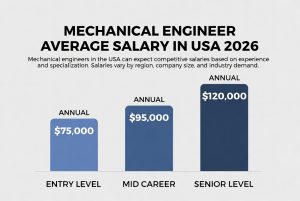

How much can your salary grow throughout your career? The path from entry-level to executive offers substantial financial growth.

-

Entry-Level / Underwriting Assistant (0-2 years): $48,113 – $60,000. Focuses on data entry, preliminary risk assessment, and supporting senior underwriters.

-

Mid-Level Underwriter (2-5 years): $65,000 – $90,000. Manages an independent book of business, makes underwriting decisions, and interacts with brokers.

-

Senior / Lead Underwriter (5-10 years): $90,000 – $116,500. Handles the most complex accounts, sets underwriting guidelines, and may have profit-and-loss responsibility for a segment.

-

Underwriting Manager / Director (10+ years): $93,284 – $122,992+. Leads a team, develops underwriting strategy, and focuses on portfolio management and business development.

Is it worth pursuing advanced designations? Absolutely. They are often linked to promotions and salary increases of 10-15% or more.

How Do Insurance Underwriter Salaries Compare to Related Roles?

Understanding the difference between an underwriter’s pay and that of related financial and insurance professions provides context for career decisions.

| Related Job Title | Average Salary (2026) | Primary Difference in Role |

|---|---|---|

| Underwriting Director | $122,992 | Executive leadership, overseeing entire underwriting department strategy. |

| Underwriting Manager | $93,284 | Team management and operational oversight of underwriting processes. |

| Risk Analyst | $92,200 | Broader focus on identifying and analyzing risks across an organization, not solely for insurance pricing. |

| Commercial Underwriter | $83,750 | Specializes in business insurance policies. |

| Insurance Underwriter (General) | $81,250 | The standard role for assessing and pricing insurance risk. |

| Insurance Analyst | $82,850 | May focus more on data analysis, market research, and supporting decision-making rather than direct risk selection. |

| Personal Lines Underwriter | $71,463 | Specializes in auto, home, and individual insurance products. |

What Are the Future Job Outlook and Earning Trends for Underwriters?

How will technology like AI and automation impact underwriter salaries and roles by 2026 and beyond? The consensus is that automation will handle routine tasks, shifting the underwriter’s role toward complex risk analysis, relationship management, and strategic decision-making. This evolution may put upward pressure on salaries for those who adapt, as the job requires higher-level judgment and technical savvy. The U.S. Bureau of Labor Statistics has historically projected stable demand, with growth tied to the overall insurance market. Professionals who combine underwriting expertise with data analytics skills will likely be in the highest demand and command the highest salaries.

How Can You Increase Your Salary as an Insurance Underwriter?

What are the best ways to boost your income in this field? A proactive strategy is essential.

-

Specialize: Move into high-demand, complex areas like cyber liability, environmental insurance, or professional liability (E&O).

-

Get Certified: Pursue and complete industry designations (CPCU, AU, ARM).

-

Develop Technical Skills: Master advanced insurance software, data modeling tools, and Excel. Understanding predictive analytics is a major differentiator.

-

Build a Portfolio: Consistently demonstrate your ability to write profitable business and manage relationships with key brokers or agents.

-

Consider Remote Opportunities: As noted, remote roles can allow you to earn a salary based on a company’s location (e.g., New York) while living in a region with a lower cost of living.

Frequently Asked Questions (FAQs)

1. What is the average starting salary for an Insurance Underwriter?

The average entry-level salary for an Insurance Underwriter in the United States in 2026 is approximately $48,113 per year. This can vary based on the company’s size, location, and the candidate’s educational background or internships.

2. How much does an Underwriter make per hour?

Based on the 2026 average annual salary of $81,250, the average hourly wage for an Insurance Underwriter is about $41.12, assuming a standard 40-hour workweek.

3. Which state pays Insurance Underwriters the most?

As of 2026, Massachusetts and Connecticut are the top-paying states, with average salaries of $90,000 per year, closely followed by New York at $89,903.

4. What is the highest salary an Insurance Underwriter can earn?

The top end of the salary range for highly experienced and specialized underwriters in senior or managerial positions can reach $116,500 or more annually. Underwriting Directors often earn above $122,992.

5. Do Insurance Underwriters get bonuses?

Yes, many underwriting positions include performance-based bonuses or profit-sharing. Bonuses can significantly increase total compensation, often ranging from 5% to 20% of base salary, depending on individual and company performance.

6. What is the difference between a Commercial and a Personal Lines Underwriter?

A Commercial Underwriter assesses risks for businesses and organizations, dealing with more complex policies and higher financial stakes, which commands a higher average salary ($83,750). A Personal Lines Underwriter evaluates risks for individuals (auto, home, life), typically involving more standardized policies and a lower average salary ($71,463).

7. Is the demand for Insurance Underwriters growing?

While automation is changing the nature of the work, demand for skilled underwriters who can manage complex risks and client relationships remains stable. The role is evolving towards more analytical and strategic functions, ensuring continued relevance.

Disclaimer: The salary data, figures, and projections presented in this article for the year 2026 are based on aggregated public sources, user submissions, and statistical modeling. They are intended for general informational and guidance purposes only. Actual salaries can vary widely based on individual qualifications, specific employer, exact geographic location, market conditions, and negotiation. This information should not be used as the sole basis for career or financial decisions.

Keywords: insurance underwriter salary, underwriter salary 2026, average underwriter salary, commercial underwriter salary, personal lines underwriter, underwriting jobs, insurance careers, risk management salary, highest paying states for underwriters, how to become an underwriter