Insurance Broker Average Salary in USA, 2026

Insurance Broker salaries in the United States are uniquely structured, combining base compensation with performance-based commissions and bonuses. As of 2026, what is the true earning potential for a broker, and how do factors like experience, location, and specialty influence income? This comprehensive analysis breaks down the national averages, state-by-state variations, and the key strategies brokers use to maximize their annual earnings in a dynamic financial landscape.

What Is the Average Salary for an Insurance Broker in the United States?

How much can you realistically expect to earn as an insurance broker? According to 2026 salary data aggregated from 10,000 professionals, the average annual salary for an Insurance Broker in the United States is $63,750. This translates to an average hourly wage of approximately $32.26. However, this median figure masks a wide range. Where does the salary spectrum begin and end? Entry-level positions with minimal experience start around $43,627 per year, while the top 10% of most experienced and successful brokers can earn upwards of $128,750 annually. The difference between the low and high ends highlights the commission-driven nature of this career, where income is directly tied to sales performance, client retention, and portfolio growth.

How Does Insurance Broker Salary Vary by State?

Location is a critical determinant of an insurance broker’s earning potential, influenced by local market demand, cost of living, and regulatory environments. Which states offer the highest average compensation for brokers?

| State | Average Annual Salary (2026) | Key Factors |

|---|---|---|

| Massachusetts | $85,000 | High cost of living, dense commercial markets, strong demand for complex coverage. |

| Connecticut | $85,000 | Concentration of corporate headquarters and high-net-worth individuals. |

| New York | $80,972 | Major financial hub with vast commercial and specialty insurance needs. |

| Idaho | $80,000 | Growing market with less saturation, potentially higher commission opportunities. |

| West Virginia | $76,960 | Possible niche markets and lower competition driving value for established brokers. |

What is the best way to interpret this data? While coastal financial centers like Massachusetts and New York offer high averages, brokers in other states can achieve significant income by specializing in local industry risks (e.g., agriculture, manufacturing) or building a dominant personal book of business. The top strategy is to align your expertise with the economic drivers of your region.

What Are the Key Factors That Influence an Insurance Broker’s Income?

An insurance broker’s salary is not a fixed figure but a function of several variables. How can you maximize your earning potential? First, compensation structure is paramount. Most brokers earn a base salary plus commission. The commission percentage, often between 10-40% of the policy premium, is where high earners differentiate themselves. How much can commissions add? A broker closing large commercial accounts can see annual commissions that dwarf their base salary.

Second, specialization dramatically impacts income. What is the difference between a general personal lines broker and a specialized one? Brokers focusing on commercial lines, employee benefits, surety bonds, or niche areas like cyber liability or professional indemnity typically command higher fees and commissions due to the complexity and value of the policies.

Third, experience and client retention are irreplaceable assets. How long does it take to build a lucrative book? It often takes 3-5 years to build a stable client base. Renewals provide recurring commission income, creating a compound growth effect on annual earnings. A broker with a 90% retention rate has a predictable and growing income stream.

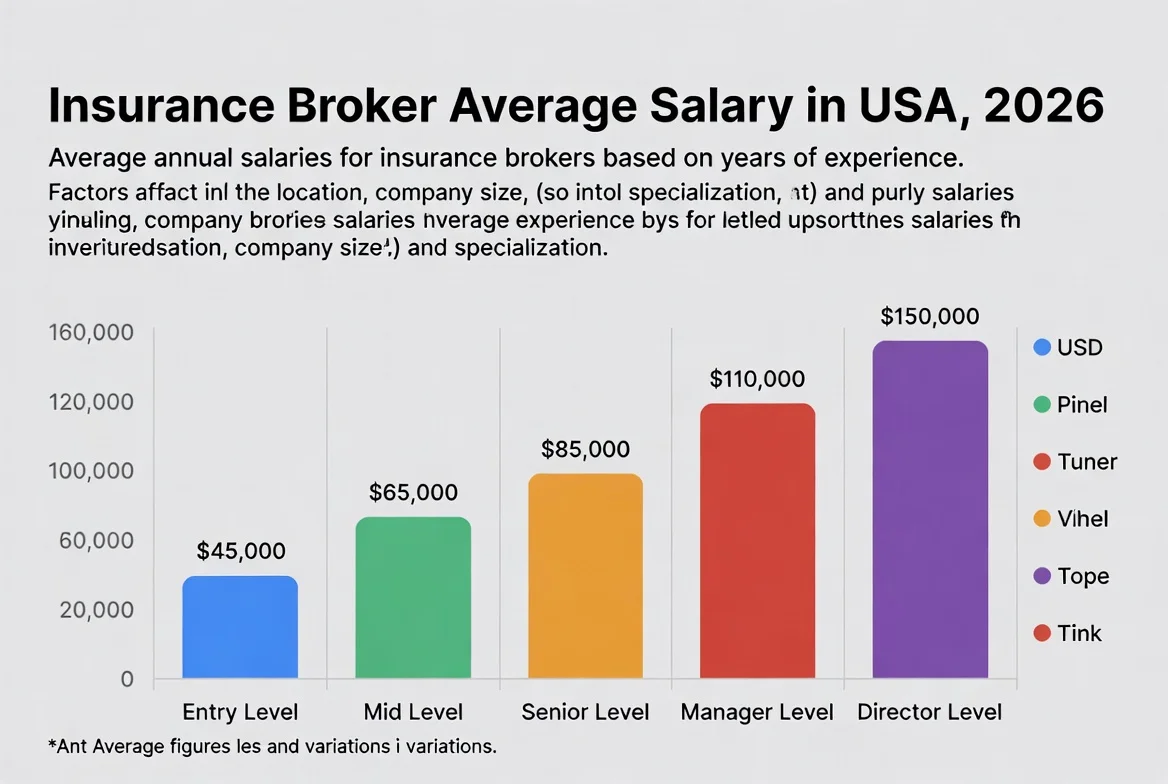

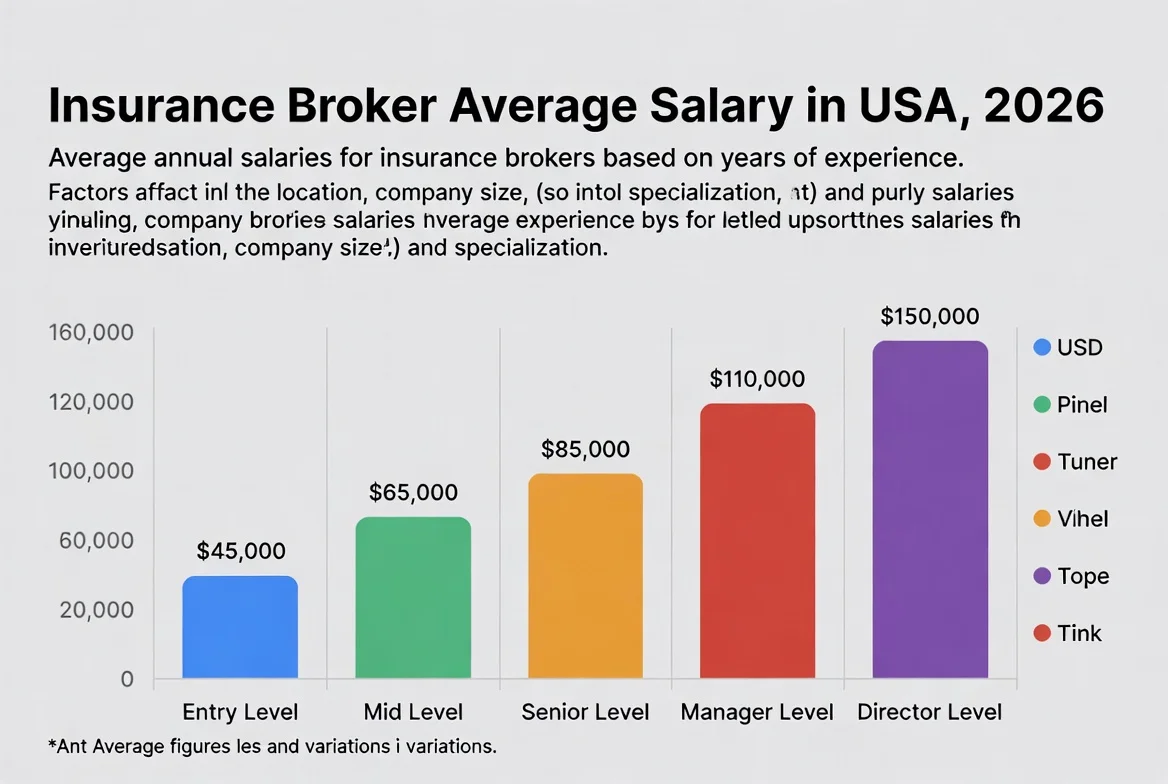

What Is the Career Path and Progression for an Insurance Broker?

Understanding the trajectory helps set realistic income expectations. What should a new broker expect in their first year? Entry-level roles often involve training, support, and a higher base-to-commission ratio, with total compensation near the lower end of the spectrum. How fast can income grow? By years 3-5, successful brokers transition to primarily commission-based roles, with earnings potentially doubling or tripling as they build their portfolio.

Senior-level positions involve managing large accounts, mentoring junior brokers, or moving into agency ownership. Which roles offer the highest ceiling? Agency owners or principals who earn overrides on the production of other brokers can far exceed the $128,750 high mark for individual contributors. The pros and cons of ownership include unlimited upside but also increased operational risk and responsibility.

How Does the Insurance Broker Job Market Look in 2026?

Is it worth becoming an insurance broker in the current climate? The demand for skilled brokers remains steady, driven by perpetual risk management needs and evolving insurance products (e.g., for climate tech, AI). What are the best ways to secure a high-paying broker position? Obtaining professional designations like Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC) significantly enhances credibility and earning potential. Furthermore, tips for success include leveraging technology for client management and focusing on consultative, relationship-based selling rather than transactional calls.

Frequently Asked Questions (FAQs)

1. What is the difference between an Insurance Agent and an Insurance Broker?

An Insurance Agent typically represents one or a few specific insurance companies and sells their products. An Insurance Broker acts as an independent intermediary who represents the client, shopping policies from multiple insurers to find the best coverage and price. Brokers often handle more complex commercial risks, which can lead to higher earning potential.

2. Do Insurance Brokers get a base salary?

Many broker positions, especially for those starting out or working at larger firms, offer a base salary plus commission. The base provides income stability while the broker builds their book of business. More established, senior brokers often work on a 100% commission draw against future earnings.

3. What percentage of commission do Insurance Brokers make?

Commission rates vary widely. How much is typical? For personal lines, commissions might range from 10-15% of the premium. For commercial lines, where policies are larger and more complex, commissions can range from 15% to 25% or more. Specialized lines or group benefits can command similar or higher percentages.

4. What skills are most important for a high-earning Insurance Broker?

The top skills include exceptional relationship-building and communication, analytical skills to assess client risk, deep product knowledge, persistence, and a high degree of self-motivation. Technical proficiency with customer relationship management (CRM) software is also essential.

5. How do bonuses work for Insurance Brokers?

Bonuses are often tied to performance metrics beyond pure sales, such as client retention rates, growth of the overall book, profitability of the accounts written, or achieving certain professional milestones. They provide an additional layer of incentive on top of commissions.

6. What are the tax implications for a broker’s income?

Brokers, especially those on high commission, should plan for taxes carefully. A significant portion of income may not have taxes withheld. Should you consult a professional? Yes, working with a tax advisor familiar with 1099 income and self-employment deductions is highly recommended to manage quarterly estimated tax payments.

7. Is the demand for Insurance Brokers growing?

According to the U.S. Bureau of Labor Statistics, employment for insurance sales agents (a category that includes brokers) is projected to show steady demand. Where is growth strongest? In areas like consulting for cyber risk, environmental liability, and employee benefits, as businesses face new and evolving threats.

Disclaimer: The salary data, figures, and career information presented in this article are based on aggregated market data from 2026 and are intended for general informational purposes only. Actual compensation can vary significantly based on individual performance, specific employer, geographic location, economic conditions, and specialization. This information should not be considered a guaranteed offer of employment or compensation.

Keywords: insurance broker average salary, insurance broker salary 2026, how much does an insurance broker make, insurance broker commission, insurance agent vs broker, insurance sales salary, commercial insurance broker salary, highest paying states for insurance brokers, insurance career path, financial services salaries