Financial Analyst Average Salary in USA, 2026

Financial Analyst salaries in the United States are a key metric for professionals navigating the corporate finance, investment, and planning sectors. As of 2026, what is the earning potential for this critical role, and which factors most significantly influence compensation? This comprehensive guide delves into the national and state-level salary data, exploring the variables that impact pay, from experience and industry to specific skills and geographic location. Understanding these dynamics is essential for both job seekers aiming to maximize their offers and employers seeking to remain competitive in a demanding talent market.

What Is the National Average Salary for a Financial Analyst in 2026?

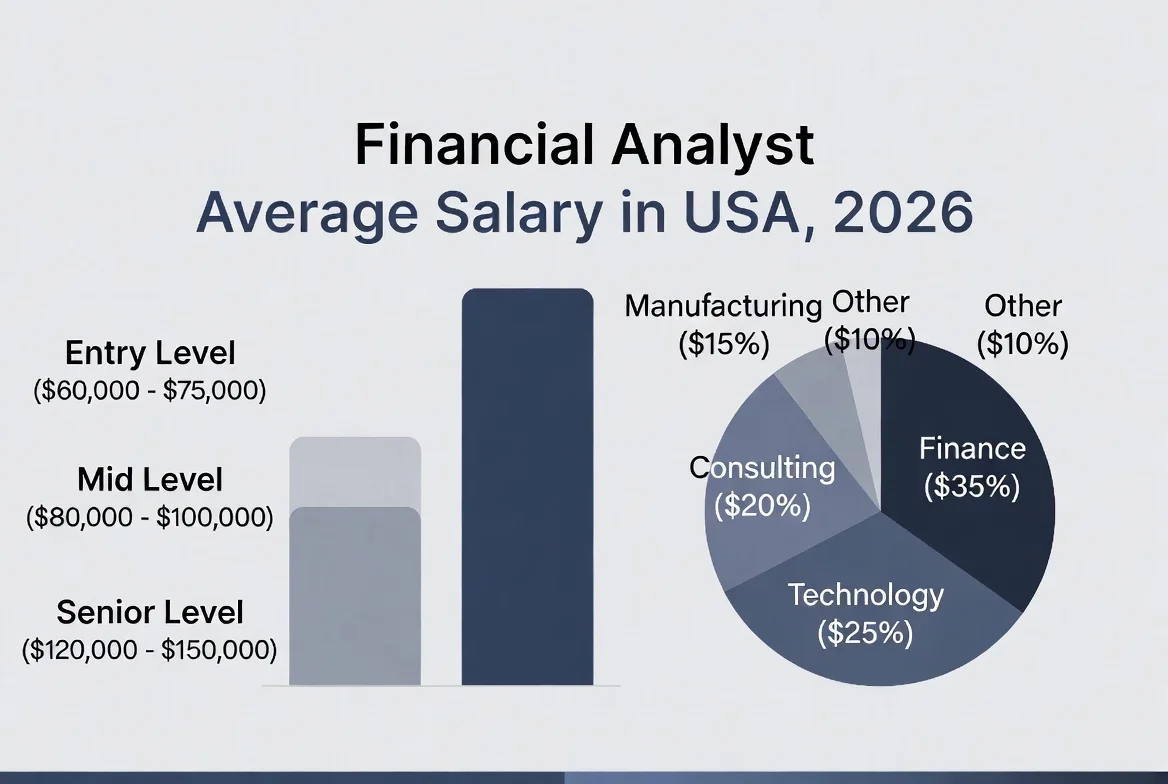

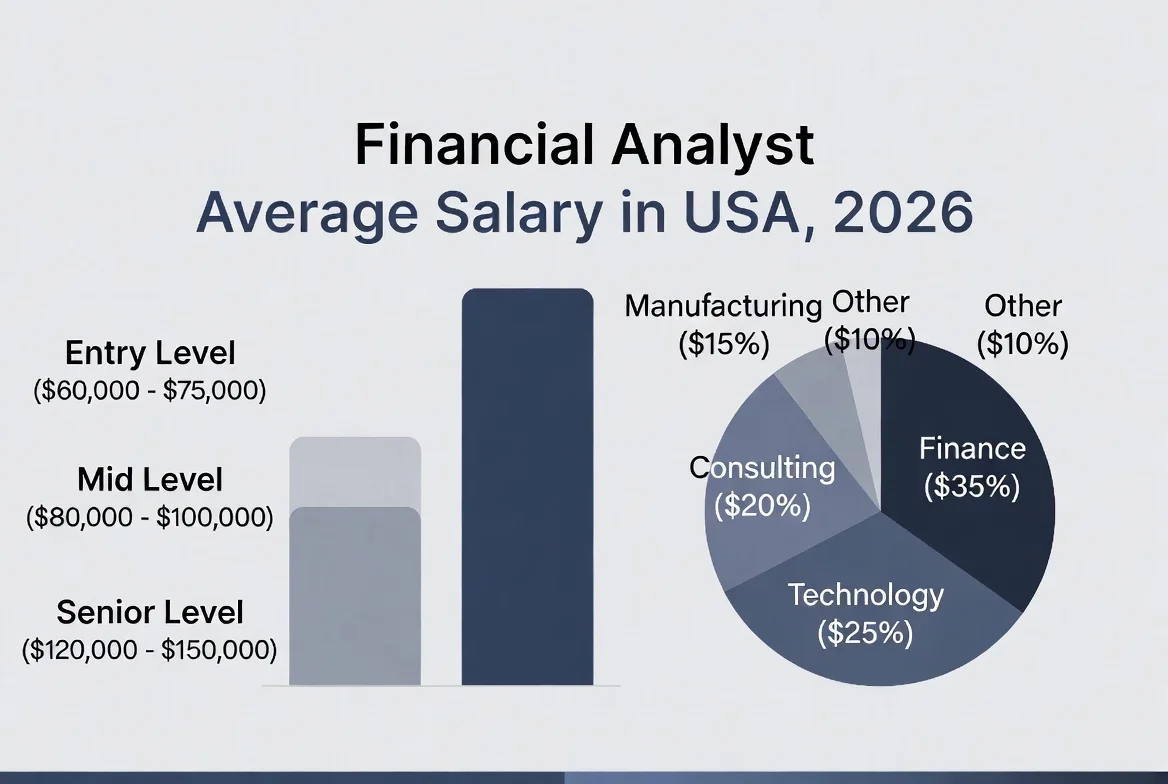

The national average provides a foundational benchmark. How much does a Financial Analyst make in the United States as of 2026? Based on aggregated salary data, the average annual salary is $84,100, which translates to approximately $42.56 per hour. This figure represents the median, meaning half of all Financial Analysts earn more, and half earn less. What is the range for entry-level versus experienced professionals? Entry-level positions typically start around $55,052 per year, while the most experienced and specialized analysts can command salaries up to $120,650 annually. This wide range highlights the significant impact of tenure, performance, and specialization within the field.

Which States Pay the Highest Salaries for Financial Analysts?

Geographic location is one of the most powerful determinants of salary. Where can Financial Analysts find the highest compensation? The top-paying states as of 2026 are led by Virginia, with an average salary of $100,381, closely followed by Maryland at $99,075. Other high-paying states include Hawaii ($94,792), California ($93,551), and New York ($92,892). What is the difference between these states and the national average? The premium can be as high as 19-20%, often reflecting the concentration of high-cost industries like defense contracting, federal government agencies, major corporate headquarters, and bustling financial hubs. How should a professional weigh a higher salary against a higher cost of living? This is a critical consideration, as a nominal salary increase in a city like San Francisco or New York may not translate to greater purchasing power.

What Factors Influence a Financial Analyst’s Salary Beyond Location?

While location is crucial, several other variables play a defining role. Which factors have the most substantial impact on pay?

-

Experience and Seniority: This is the most direct correlation. An analyst with 2-4 years of experience may see a 20-35% increase over an entry-level salary, while a Senior Financial Analyst or Finance Manager can command 50-100% more.

-

Industry and Sector: What is the difference between working in technology versus manufacturing? Analysts in investment banking, private equity, hedge funds, and major technology firms typically earn the highest base salaries and bonuses. Industries like healthcare, energy, and aerospace/defense also offer strong compensation packages.

-

Education and Certifications: A Master of Business Administration (MBA) or a Chartered Financial Analyst (CFA) designation can significantly boost earning potential. Is it worth pursuing these credentials? For roles in portfolio management, equity research, and corporate strategy, these are often considered essential and can lead to a 10-20% salary premium.

-

Specific Skills: Proficiency in advanced data analytics tools (SQL, Python, R), enterprise resource planning (ERP) systems like SAP or Oracle, and sophisticated financial modeling is increasingly valuable.

How Does Career Progression Affect Earnings for a Financial Analyst?

The career path for a Financial Analyst offers substantial growth in responsibility and compensation. What are the best ways to advance? A typical progression might look like this:

-

Financial Analyst (0-3 years): Focus on reporting, variance analysis, and basic modeling. Salary range: $55,052 – $75,000.

-

Senior Financial Analyst (3-6 years): Manages budgeting/forecasting processes, leads analyses for business units, and mentors junior staff. Salary range: $85,000 – $110,000.

-

Finance Manager or Controller (6+ years): Oversees a team, manages closing processes, and interfaces directly with senior leadership. Salary range: $110,000 – $150,000+.

-

Director of Finance or CFO (10+ years): Sets financial strategy, leads fundraising, and is a key strategic partner to the CEO. Salary range: $150,000 – $300,000+.

How long does it typically take to move from an analyst to a manager role? With strong performance and skill development, this transition can often occur within 5-7 years.

What Are the Related Job Titles and Their Salaries?

Understanding the salary landscape for adjacent roles provides context for career mobility. Which related positions offer comparable or higher earnings?

| Related Job Title | Average Salary (2026) | Primary Difference from Financial Analyst |

|---|---|---|

| Finance Director | $122,992 | Strategic leadership role overseeing entire finance department. |

| Controller | $117,586 | Focus on accounting accuracy, reporting, and compliance. |

| Portfolio Manager | $94,534 | Investment-focused role managing assets and making buy/sell decisions. |

| Underwriter | $105,000 | Risk assessment role, common in insurance and lending. |

| Tax Manager | $100,000 | Specialization in tax strategy, planning, and compliance. |

This comparison shows that specializing in a niche like tax or moving into pure investment management can offer a different, often higher, compensation trajectory.

What Is the Job Outlook and Demand for Financial Analysts in 2026?

How is the job market evolving for this profession? The demand for Financial Analysts remains strong, driven by data-driven decision-making, economic complexity, and regulatory environments. Which industries are growing the fastest for this role? Sectors like fintech, renewable energy, and healthcare technology are creating new opportunities that blend traditional financial analysis with data science. What are the pros and cons of the current market? The pros include robust demand and clear advancement paths. The cons involve increasing competition for top roles and the constant need to upskill in technology and analytics.

How Can You Negotiate a Competitive Financial Analyst Salary?

Securing a competitive offer requires strategy. What should you do before entering negotiations?

-

Research Thoroughly: Use data from sources like the Bureau of Labor Statistics, Glassdoor, and LinkedIn Salary to benchmark your offer against local and industry standards.

-

Quantify Your Value: Prepare examples of how your analysis saved money, identified growth opportunities, or improved efficiency in past roles.

-

Consider the Total Package: How much is the bonus, equity, or benefits package worth? A slightly lower base salary with a strong performance bonus and excellent healthcare/retirement benefits may be more valuable.

-

Practice Your Pitch: Be prepared to clearly and confidently articulate your expected salary range based on your research and skills.

Frequently Asked Questions (FAQs)

1. What is the single biggest factor affecting a Financial Analyst’s salary?

While multiple factors are at play, geographic location coupled with industry consistently creates the widest salary disparities. An analyst with three years of experience in investment banking in New York City will likely earn significantly more than a peer with similar experience in a manufacturing firm in the Midwest.

2. How much does a CFA or MBA increase a Financial Analyst’s salary?

Earning a Chartered Financial Analyst (CFA) designation or a top-tier Master of Business Administration (MBA) can increase earning potential by 15-25% or more, depending on the role and employer. These credentials are particularly valuable for roles in asset management, equity research, and corporate development.

3. Are Financial Analyst salaries keeping up with inflation in 2026?

Salary growth has generally kept pace with or slightly exceeded inflation in many sectors, especially for roles requiring advanced technical and analytical skills. However, this varies by industry and company performance. It’s crucial to research current, localized data during your job search or review cycle.

4. What is the difference between a Financial Analyst in corporate finance vs. investment banking?

A Corporate Financial Analyst typically works within a company, focusing on budgeting, forecasting, and operational analysis to support internal decisions. An Investment Banking Analyst works at a bank, focusing on transactions like mergers, acquisitions, and capital raising for clients. The latter often commands a higher base salary and a substantial year-end bonus but typically requires longer hours.

5. Is remote work affecting Financial Analyst salaries?

The rise of remote and hybrid work has introduced more nuance. Some companies now adjust salaries based on the employee’s location rather than the company’s headquarters (“location-based pay”). Others, particularly in competitive fields, may offer national market rates to attract top talent regardless of location.

6. What skills are most in demand for Financial Analysts in 2026?

Beyond core accounting and Excel proficiency, demand is highest for skills in data visualization (Power BI, Tableau), programming for data analysis (Python, R), advanced financial modeling, and a strong understanding of ERP systems. Soft skills like business communication and strategic thinking are equally critical.

7. How does the bonus structure work for Financial Analysts?

Bonuses can vary widely. In corporate roles, bonuses may range from 5% to 15% of base salary, tied to company and individual performance. In finance-centric roles like investment banking or private equity, bonuses can be substantially higher, often 50% to 100%+ of the base salary.

Disclaimer: The salary data, figures, and career advice provided in this article are for general informational purposes only as of 2026. They are based on aggregated market data and trends, which can fluctuate based on economic conditions, company performance, and individual circumstances. The user is solely responsible for conducting their own due diligence and negotiation. This information should not be considered as guaranteed salary offers or professional financial advice.

Keywords: financial analyst salary, average salary financial analyst usa, financial analyst jobs, senior financial analyst salary, finance careers, financial analyst career path, highest paying states for financial analysts, financial analyst skills 2026, corporate finance salary, investment banking analyst salary