Financial Advisor Average Salary in USA, 2026

Financial Advisor salaries in the United States vary significantly based on experience, credentials, compensation structure, and geographic location. What is the true earning potential for a Financial Advisor in 2026, and how does base salary differ from total compensation? This comprehensive analysis breaks down the national averages, state-by-state data, key influencing factors, and the best strategies to maximize income in this dynamic profession. Understanding these nuances is essential for both aspiring and current advisors navigating their career trajectory and for clients evaluating professional services.

What Is the Average Base Salary for a Financial Advisor in the USA?

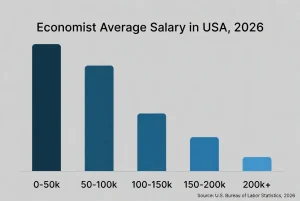

The reported average base salary provides a starting point, but it only tells part of the story. How much does a Financial Advisor make on average? As of 2026, the average base salary for a Financial Advisor in the United States is $55,793 per year, which equates to approximately $28.24 per hour. However, this median figure masks a wide range. Where do entry-level and experienced advisors fall? Entry-level positions often start around $40,130 per year, while the top 25% of most experienced workers can earn base salaries upwards of $111,082 per year. It’s crucial to understand that many advisors earn a substantial portion of their income through commissions and bonuses, which are not reflected in base salary figures.

Which States Pay the Highest Salaries for Financial Advisors?

Location is one of the most significant factors affecting a Financial Advisor’s earnings. What is the difference between the highest and lowest paying states? The disparity can be dramatic, often correlating with the concentration of high-net-worth individuals, financial hubs, and state cost of living.

Top 5 Highest-Paying States (2026):

-

Virginia: $94,063

-

New York: $92,903

-

Massachusetts: $91,832

-

New Jersey: $91,213

-

Connecticut: $89,833

Bottom 5 Lowest-Paying States (2026):

-

Wyoming: $50,125

-

Mississippi: $52,500

-

Arkansas: $53,585

-

New Mexico: $53,759

-

Idaho: $53,840

How can you use this geographic data? Advisors may consider licensure in multiple states or focus their client acquisition efforts in metropolitan areas within high-earning states to maximize their potential.

How Do Experience and Specialization Impact Earnings?

Beyond location, an advisor’s career stage and niche are critical. What are the best ways to increase your salary as a Financial Advisor? The progression is typically tied to assets under management (AUM), client retention, and obtaining advanced certifications.

-

Entry-Level (0-3 years): Focuses on building a book of business. Income is often lower and heavily reliant on base salary or small commissions.

-

Mid-Career (4-10 years): With a established client base, earnings grow significantly through recurring fees (e.g., 1% of AUM) and performance bonuses.

-

Senior-Level (10+ years): Top earners often have large, stable AUM, may have moved into a practice leadership or partner role, and earn through substantial fees, overrides, and profit sharing.

Which specializations command higher fees? Advisors focusing on retirement planning, estate planning, or serving corporate executives and physicians often have higher average client assets and can justify premium fees compared to those focusing on general wealth management.

What Is the Typical Compensation Structure for Financial Advisors?

Understanding the pay mix is key to interpreting salary data. How do the various compensation models work? There are three primary structures:

-

Fee-Only: Advisors charge a percentage of AUM, an hourly rate, or a flat retainer. This model is seen as minimizing conflicts of interest and can lead to high earnings as AUM grows.

-

Commission-Only: Advisors earn from selling financial products (insurance, mutual funds). Earnings are less predictable but offer high upside for successful salespeople.

-

Fee-Based: A hybrid model combining fees (for planning) and commissions (for product implementation). This is the most common structure.

How much of total compensation is variable? For many advisors, 50% or more of their total annual income can come from bonuses and commissions, making the base salary just one component of their total earnings.

What Are the Essential Skills and Certifications to Boost Your Salary?

In a competitive field, credentials are currency. What should you invest in to advance your career and salary? Beyond the mandatory Series 7 and 66 licenses, advanced designations are a best way to signal expertise and justify higher fees.

| Certification | Focus Area | Estimated Salary Premium | Time/Cost Investment |

|---|---|---|---|

| CFP® (Certified Financial Planner) | Comprehensive Financial Planning | 15-25% Higher Earnings | High |

| CFA® (Chartered Financial Analyst) | Investment Analysis & Portfolio Management | 20-35% Higher Earnings | Very High |

| ChFC® (Chartered Financial Consultant) | Advanced Financial Planning | 10-20% Higher Earnings | High |

| CPWA® (Certified Private Wealth Advisor) | High-Net-Worth Clients | 25-40% Higher Earnings | High |

Is it worth pursuing these certifications? The data strongly suggests yes, as they directly correlate with increased credibility, ability to handle complex cases, and ultimately, higher compensation.

How Does the Job Outlook for Financial Advisors Affect Future Salaries?

The demand for financial advice is a key driver of earning potential. What is the projected job growth? The U.S. Bureau of Labor Statistics projects demand for personal financial advisors to grow faster than the average for all occupations through 2026 and beyond, fueled by an aging population, pension shifts, and growing complexity in tax and retirement planning.

Which factors will influence future salaries? The increasing adoption of robo-advisors may pressure fees for basic investment management, pushing human advisors to provide more complex, holistic planning services that justify their fees. Advisors who leverage technology to enhance their service, rather than being replaced by it, will likely see the strongest salary growth.

How to Negotiate Your Salary or Fee Structure as a Financial Advisor?

Whether joining a firm or setting your own fees, negotiation is critical. How can you effectively negotiate for higher pay?

-

For Employed Advisors: Base your request on tangible metrics like your projected AUM growth, client satisfaction scores, or revenue you generate for the firm.

-

For Independent Advisors: Your fee schedule should reflect your expertise, the complexity of services, and local market rates. Clearly articulate the value proposition to the client.

When is the best time to negotiate? Typically during annual reviews, when transitioning firms, or when renewing agreements with major clients. Always come prepared with data to support your request.

Frequently Asked Questions (FAQs)

1. What is the difference between a Financial Advisor and a Financial Planner?

A Financial Advisor is a broader term for anyone who provides financial advice and may sell products. A Financial Planner is a specific type of advisor who creates comprehensive, long-term plans covering budgeting, investing, taxes, retirement, and estate planning. Many planners hold the CFP® certification.

2. Can you make over $200,000 as a Financial Advisor?

Yes, it is possible, especially for experienced advisors with a large and loyal book of business. High earners typically have over $100 million in assets under management, specialize in a lucrative niche, or have an ownership stake in their practice. Total compensation at this level often includes significant bonuses and profit sharing.

3. What are the pros and cons of being a Financial Advisor?

Pros: High earning potential, intellectual challenge, ability to help clients achieve goals, flexible schedule (often), and entrepreneurial opportunity.

Cons: High stress, irregular income especially early on, significant compliance and regulatory burdens, need for continuous education, and the challenge of constant client acquisition.

4. How do I become a Financial Advisor?

The typical path involves: 1) Earning a bachelor’s degree (often in finance, economics, or business). 2) Passing the required licensing exams (Series 7 and Series 66 or 65). 3) Gaining experience through an entry-level position at a bank, brokerage, or insurance firm. 4) Optionally, pursuing advanced certifications like the CFP®.

5. Is the salary for Financial Advisors mostly commission?

It varies by firm and role. Many positions, especially at major brokerages, are fee-based, meaning a lower base salary is supplemented by commissions and bonuses. Fee-only RIAs (Registered Investment Advisors) typically earn a salary plus bonuses based on firm profitability, with no direct commissions from product sales.

6. How much do top Financial Advisors at major firms (e.g., Fidelity, Morgan Stanley) make?

Top producers at major wirehouses and brokerages can earn well into the seven figures. Their compensation is a complex mix of grid-based payouts (a percentage of the revenue they generate), bonuses for hitting asset and net new asset targets, and often stock awards. First-year advisors, however, may earn a modest salary as they build their practice.

7. What is the impact of robo-advisors on human advisor salaries?

Robo-advisors have commoditized basic portfolio management, pushing down fees for that service. This has pressured human advisors to move upstream, focusing on more complex financial planning, behavioral coaching, and niche expertise. This shift can actually increase average salaries for advisors who successfully adapt and differentiate their value.

Disclaimer: The salary data, state comparisons, and career information provided in this article are for general informational purposes only. Figures are based on aggregated public data as of 2026 and are subject to change. Actual compensation for any individual can vary widely based on specific employer, performance, client base, certifications, and local economic conditions. This information should not be used as the sole basis for career or financial decisions.

Keywords: financial advisor average salary, financial advisor salary 2026, CFP salary, wealth management compensation, financial planner earnings, highest paying finance jobs, financial advisor commission, fee-based advisor salary, financial advisor career path, financial advisor certifications