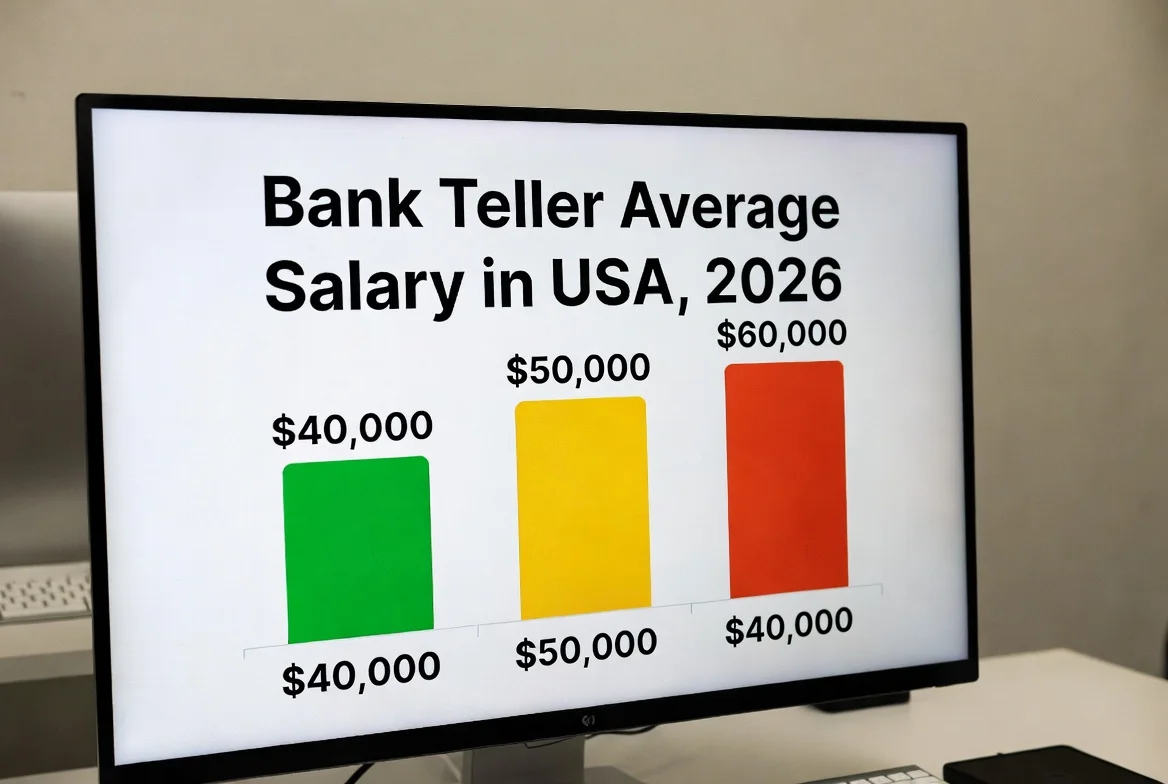

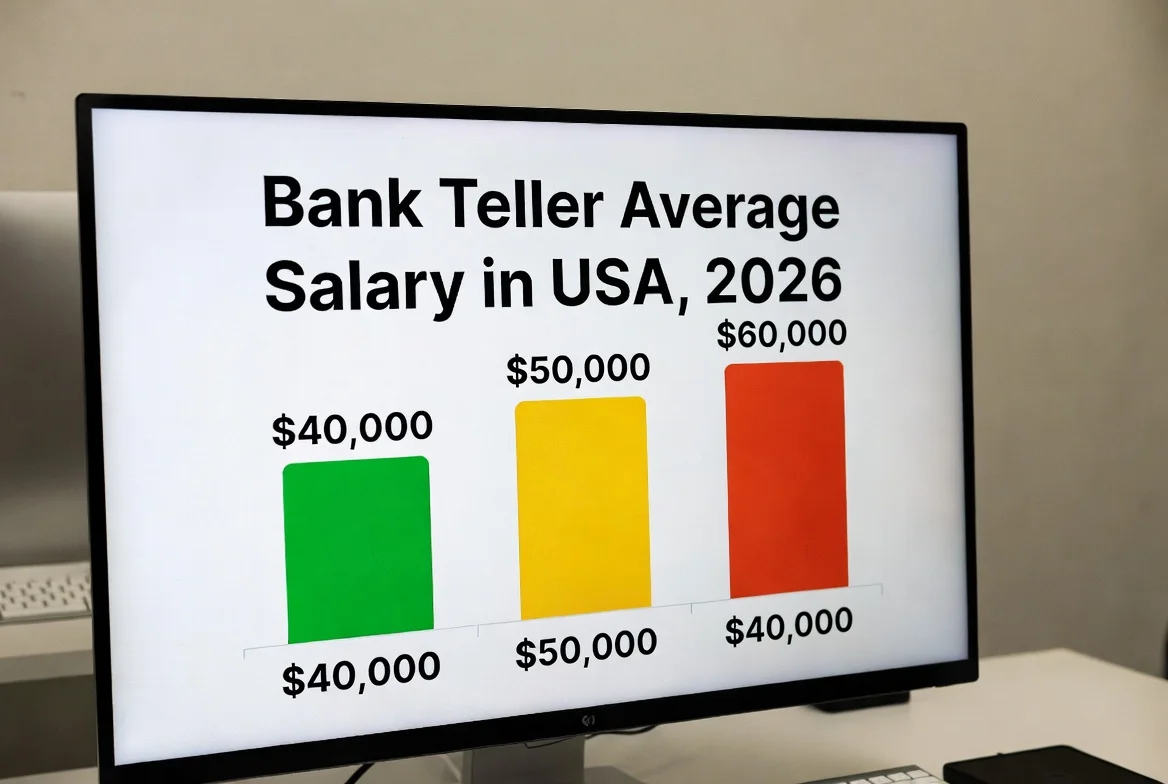

Bank Teller Average Salary in USA, 2026

Bank Teller salaries in the United States represent an entry-point into the financial services industry, with compensation varying significantly by experience, location, and institution size. As of 2026, what is the true earning potential for this role, and how do factors like state residency or career progression impact it? This detailed analysis breaks down the national averages, regional disparities, and related career paths, providing a clear financial picture for current and aspiring tellers.

What Is the National Average Salary for a Bank Teller in 2026?

How much can you expect to earn as a Bank Teller in the United States? According to aggregated 2026 salary data from major employment platforms, the average annual salary for a Bank Teller is $42,661. This translates to an average hourly wage of approximately $21.59. Where does this figure place tellers in the broader job market? It is considered an entry-level wage for the financial sector, often serving as a foundational role. The salary range is notably wide: entry-level positions typically start around $35,295 per year, while the top 10% of experienced workers can earn upwards of $149,423 annually. This disparity highlights that tenure, specialized skills, and performance in upselling financial products can lead to substantial income growth over time.

Which U.S. States Pay the Highest and Lowest Salaries for Bank Tellers?

Where you work has a profound impact on your take-home pay. What is the difference between the highest and lowest paying states? The data for 2026 reveals extreme geographical variations.

-

Top-Paying States: Delaware leads surprisingly with an average of $112,500, likely skewed by high-cost living areas and major banking hubs. It is followed by New York ($72,841) and Virginia ($70,928), states with significant financial sector activity.

-

Mid-Range States: California ($50,687), Illinois ($49,822), and Texas ($43,968) represent the national median range, aligning closely with cost-of-living adjustments.

-

Lowest-Paying States: On the lower end, states like West Virginia ($29,250), Louisiana ($30,225), and Oklahoma ($33,150) report averages below the national mean, often correlating with lower regional living costs and smaller banking markets.

How can you use this information? If relocation is an option, targeting states with higher averages can be beneficial. However, always adjust for the local cost of living—a higher salary in New York may not afford the same lifestyle as a moderate salary in Texas.

How Do Experience and Career Progression Affect a Bank Teller’s Pay?

Starting as a teller is often the first step on a banking career ladder. What are the best ways to increase your salary from an entry-level position? Movement typically happens in two ways: vertical promotion and lateral skill expansion.

-

Vertical Promotion: Advancing to a Teller Supervisor or Head Teller role sees average salaries jump to approximately $48,390. Further progression into Assistant Branch Manager positions can push earnings well into the $50,000 – $65,000 range.

-

Lateral/Related Roles: Many tellers transition into Universal Banker roles (avg. $44,899), which combine teller duties with basic platform services like account openings and loan inquiries, commanding a higher wage. Moving into a Personal Banking Representative ($42,068) or Account Representative ($48,488) role are also common, performance-driven paths.

How much of a raise can you expect with experience? While annual merit increases may be 2-4%, a promotion or role change can result in a 10-20% salary increase. The top earners (over $149,423) often include those in specialized, high-volume locations or those who have moved into hybrid sales-management positions.

What Benefits and Perks Are Commonly Offered Beyond Base Salary?

When evaluating total compensation, base salary is only one component. What should you consider beyond the hourly wage? Most full-time bank teller positions offer a comprehensive benefits package that significantly increases total compensation value.

-

Retirement Plans: Access to 401(k) or 403(b) plans, often with a company match (e.g., 3-6% of salary).

-

Health Insurance: Medical, dental, and vision plans, with employers typically covering a substantial portion of the premium.

-

Paid Time Off (PTO): Accrued vacation days, sick leave, and paid holidays.

-

Employee Discounts: Preferred rates on bank products like mortgages, auto loans, and credit cards.

-

Tuition Assistance/Reimbursement: A key perk for those looking to advance their education in finance or business.

Is it worth taking a slightly lower base salary for a richer benefits package? For long-term financial health and career development, often yes. A robust benefits package can add thousands of dollars in value annually.

How Does the Bank Teller Job Market Look in 2026?

What are the pros and cons of pursuing a teller career in the current landscape? The role is evolving due to digital banking.

-

Pros: High demand for customer service skills, low barrier to entry (typically a high school diploma), strong pathway for internal promotion within large banks, and high job security in essential services.

-

Cons: Increasing automation of routine transactions, pressure to meet sales quotas, and potential for stagnant wages without proactive skill development.

Which skills are most valuable to increase employability and pay? Beyond cash handling, proficiency in CRM software, knowledge of compliance regulations, and demonstrated sales ability for referring clients to mortgage or investment advisors are highly sought after.

Table: Bank Teller Salary Snapshot & Related Roles (2026)

| Position Title | Average Annual Salary (USA) | Key Differentiator from Standard Teller Role |

|---|---|---|

| Teller Supervisor | $48,390 | Leadership duties, oversight of teller line, handling complex transactions. |

| Universal Banker | $44,899 | Hybrid role; performs teller duties + opens accounts & processes loan applications. |

| Personal Banking Rep | $42,068 | Focus on customer relationship management & selling basic bank products. |

| Bank Teller (Average) | $42,661 | Core transactional role: deposits, withdrawals, check cashing. |

| Customer Service Rep (Bank) | $43,290 | May handle phone/online inquiries more than in-person transactions. |

| Teller | $38,125 | Often denotes an entry-level or part-time position with limited duties. |

Frequently Asked Questions (FAQs)

1. What is the starting salary for a Bank Teller with no experience?

In 2026, the typical starting salary for a Bank Teller with no prior experience is approximately $35,295 per year, or about $16.97 per hour. This can vary by bank and location, with major national banks often offering slightly higher starting wages and better training programs.

2. Do Bank Tellers get commissions or bonuses?

Many banks offer incentive-based bonuses for tellers who successfully refer customers to loan officers, financial advisors, or new account products. While base pay is standard, quarterly or annual bonuses can add 1-5% to total compensation for top performers.

3. What are the typical work hours for a Bank Teller?

Most tellers work standard banking hours, typically from 9:00 AM to 5:00 PM, Monday through Friday. Many positions also require working on Saturday mornings. Part-time positions are very common in this field.

4. What qualifications are needed to become a Bank Teller?

The minimum requirement is usually a high school diploma or GED. Key hiring factors include strong numerical ability, customer service experience, attention to detail, and a clean financial background (as a credit and criminal check is standard).

5. Is being a Bank Teller a good career path?

It is an excellent entry-point career. It provides foundational experience in finance, customer service, and sales. For motivated individuals, it can lead directly to promotions into higher-paying roles like Personal Banker, Loan Officer, or Branch Management within a few years.

6. How does salary growth for a Bank Teller compare to inflation?

Salaries for teller roles have seen modest growth, generally tracking near or slightly above core inflation rates in recent years. Significant pay increases are typically tied directly to promotions or moving to a higher-paying financial institution.

Disclaimer: The salary data, averages, and figures presented in this article are based on aggregated public sources and estimates for the 2026 calendar year. They are intended for informational and guidance purposes only. Actual compensation can vary widely based on individual qualifications, the specific employer, geographic location, and market conditions. The user is solely responsible for their career and financial decisions.

Keywords: bank teller salary, average bank teller pay, teller hourly wage, bank teller jobs, entry level banking salary, financial teller salary, bank teller career path, teller supervisor salary, universal banker salary, banking industry wages 2026