Accounts Payable Specialist Salary in the United States

What is the Average Accounts Payable Specialist Salary in the United States of America in 2026?

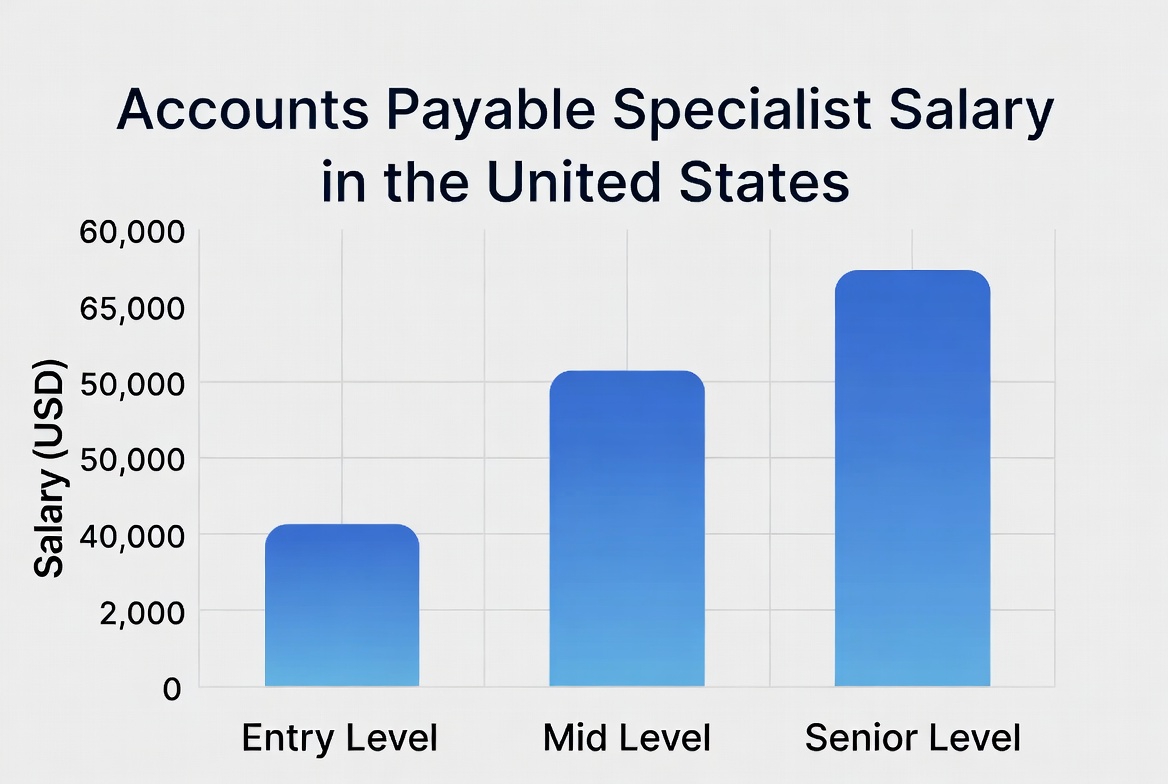

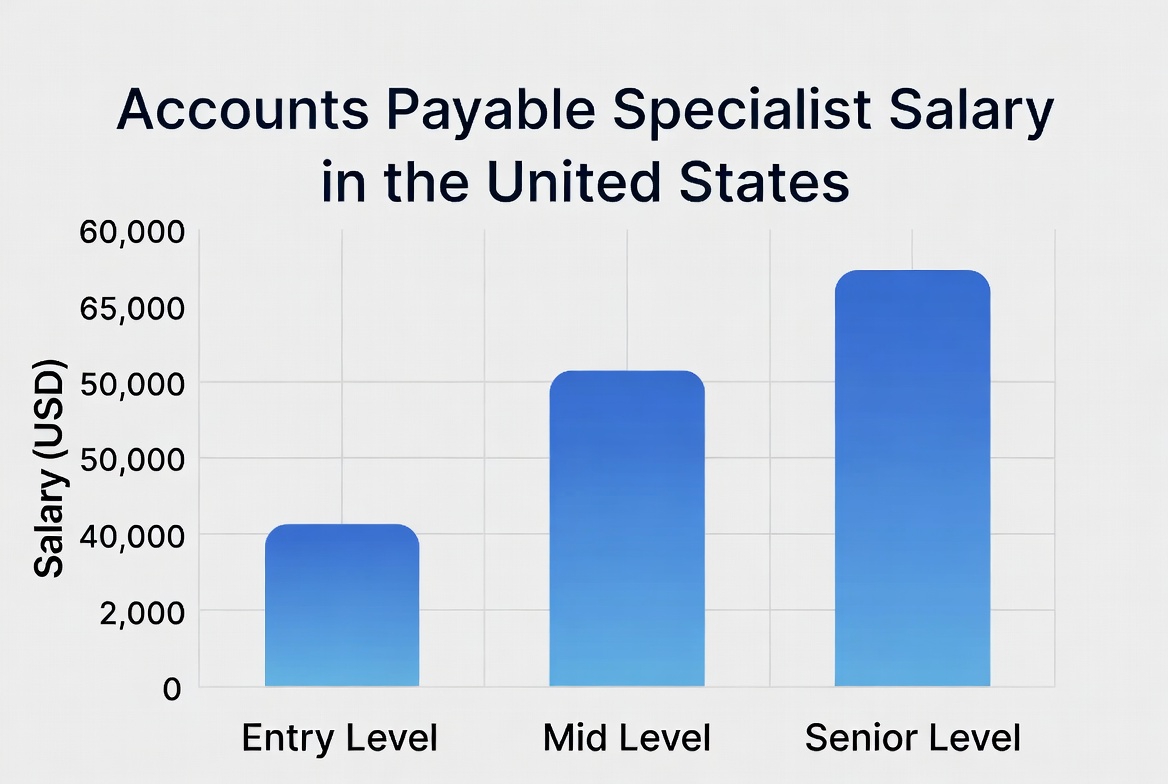

How much does an Accounts Payable Specialist make in the United States of America? This is a critical question for professionals managing one of the most essential functions in any business: ensuring vendors are paid accurately and on time. As of 2026, data reveals that the national average salary for an Accounts Payable Specialist is $58,338 per year. This median figure provides a central benchmark, indicating that half of the professionals in this role earn more, while the other half earn less. When analyzed on an hourly basis, this average equates to approximately $29.52 per hour for a standard full-time schedule. However, this average only tells part of the story. The salary range for this position is remarkably broad, reflecting varying levels of experience, responsibility, and geographic demand. Entry-level positions, often suitable for those with an associate degree or some relevant experience, typically start around $43,044 per year. Conversely, highly experienced specialists who take on supervisory duties, manage complex payment systems, or work in high-stakes industries can see their compensation rise dramatically, with top earners making up to $116,500 annually. What accounts for this wide disparity? Factors such as industry sector, company size, mastery of enterprise resource planning (ERP) software, and additional certifications all play pivotal roles in determining where an individual falls on this spectrum. Is this role a gateway to more advanced accounting positions? For many, it serves as a foundational career step, offering hands-on experience with financial operations that is invaluable for progression into roles like Staff Accountant or Accounting Manager.

How Much Does an Accounts Payable Specialist Make in Different U.S. States? A 2026 Geographic Breakdown

The average salary for an Accounts Payable Specialist is not uniform across the country; it fluctuates significantly based on regional economic conditions and the cost of living. States with a higher concentration of corporate headquarters, major financial operations centers, or a substantially elevated cost of living typically offer higher compensation to attract and retain skilled professionals. According to the latest 2026 data, states like Virginia lead with an average salary of $60,218, closely followed by Maryland at $60,024 and California at $59,570. Even within these states, metropolitan areas such as Northern Virginia (near Washington D.C.), Baltimore, or the San Francisco Bay Area will likely offer premiums compared to more rural counties. This geographic salary variance raises an important consideration for job seekers: is a higher nominal salary in a state like California truly advantageous when factoring in significantly higher housing and transportation costs? Professionals are encouraged to use detailed cost-of-living calculators to compare the real value of salary offers across different states. The trend shows that while coastal and economically dense states offer higher pay, opportunities with competitive relative value also exist in growing inland business hubs.

| State | 2026 Average Accounts Payable Specialist Salary | Key Economic & Industry Drivers |

|---|---|---|

| Virginia | $60,218 | Proximity to Washington D.C., defense contractors, government subcontractors, tech corridor. |

| Maryland | $60,024 | Biotechnology, healthcare, federal agencies, advanced research and development. |

| California | $59,570 | Technology sector, entertainment, international trade, very high cost of living in major metros. |

| New York | $59,305 | Financial services, corporate HQs, publishing, fashion, intense competition for talent. |

| Texas | $56,800 (Est.) | Energy sector, manufacturing, no state income tax, major corporate relocation destination. |

What Key Factors Influence an Accounts Payable Specialist’s Earnings in 2026?

An Accounts Payable Specialist’s salary is influenced by a combination of tangible skills, experience, and workplace characteristics. Years of experience is the most straightforward driver; with each year of proficient work, specialists can expect incremental increases, often outlined in a company’s pay scale. Industry selection is equally powerful. Specialists working in finance and insurance, scientific and technical services, or management of companies often command higher salaries than those in retail, education, or non-profit sectors due to the complexity and volume of transactions. Technical proficiency is a major differentiator. Expertise in major ERP systems like SAP, Oracle, or NetSuite, or in automation and workflow software, can significantly boost earning potential. Furthermore, taking on additional responsibilities such as expense reporting, corporate card reconciliation, or supervising a small team can transition a specialist into a senior or lead role with corresponding pay increases. Professional certifications, while not always mandatory, can provide an edge. Credentials like the Certified Accounts Payable Professional (CAPP) or foundational bookkeeping certifications demonstrate a commitment to the field and a mastery of best practices, making a candidate more valuable to employers. Does the size of the company matter? Typically, larger corporations have more complex processes and larger teams, which can lead to higher salaries and better-defined career ladders compared to small businesses, though the latter may offer broader role exposure.

Is an Accounts Payable Specialist a High-Paying Job Compared to Other Accounting Roles?

To understand the earning potential of an Accounts Payable Specialist, it’s useful to compare it to related positions within the accounting and finance department. With a median salary of $58,338, the role sits at an entry-to-mid level in the financial career hierarchy. For instance, a Staff Accountant, who handles more generalized accounting tasks including journal entries and account reconciliation, has a higher average salary of $86,583. An Accounting Analyst, focused on financial data interpretation and reporting, averages $77,687. More senior roles like Accounting Manager ($93,284) and Office Manager with financial oversight ($100,000) command significantly higher pay due to their management responsibilities and broader scope. This comparison illustrates a clear career progression path. Many professionals begin as Accounts Payable or Accounts Receivable Specialists to gain crucial practical experience before advancing through further education (like a bachelor’s degree in accounting), obtaining certifications, and moving into more analytical or managerial positions. Therefore, while not the highest-paying job in finance initially, it is a vital and stable role that serves as a critical stepping stone with strong potential for growth and increased earnings over time.

Frequently Asked Questions (FAQ) About Accounts Payable Specialist Salaries

Q: How much would I take home after taxes on a $58,338 salary?

A: Your net pay is highly dependent on your state of residence, filing status (single, married), and pre-tax deductions (like retirement contributions). As a general estimate, a single filer claiming the standard deduction in a state with moderate taxes might have an annual take-home pay of approximately $42,000 to $47,000. Using a reliable online paycheck calculator with your specific details is crucial for an accurate picture.

Q: What is the career outlook for Accounts Payable Specialists?

A: The demand for Accounts Payable Specialists remains steady. While automation handles more repetitive data entry, the need for professionals who can manage exceptions, ensure compliance, work with complex systems, and analyze vendor relationships is growing. The role is evolving from transactional to more analytical and relationship-focused.

Q: What skills are most valued to increase my salary in this role?

A: To maximize your earning potential, focus on: 1) Achieving mastery in a major ERP software platform, 2) Developing data analysis skills using Excel or similar tools, 3) Gaining experience with process improvement and automation, 4) Understanding sales and use tax regulations, and 5) Cultivating strong vendor communication and negotiation skills.

Q: Do Accounts Payable Specialists typically receive bonuses?

A: Bonus structures vary by company. Many specialists are eligible for annual performance bonuses, which may range from 2-5% of their base salary. Some companies also offer spot bonuses for exceptional work or profit-sharing plans.

Keywords: Accounts Payable Specialist Salary, Average AP Specialist Salary USA 2026, Entry Level Accounts Payable Salary, Accounts Payable Clerk Salary, Hourly Wage for AP Specialist, Accounts Payable Specialist Jobs, Finance Operations Salary, Accounting Support Roles, Salary by State for AP

Disclaimer: The salary figures, averages, and ranges presented in this article are synthesized from aggregated market data and surveys for the 2026 period and are intended for informational purposes only. Actual compensation can vary widely based on individual qualifications, specific employer, exact job duties, local economic conditions, and negotiation. This information should not be construed as guaranteed earnings or formal financial or career advice. For the most precise and current salary information, individuals should consult specialized job boards, salary surveys like those from the Bureau of Labor Statistics, and professional networking resources within their specific geographic and industry niche.