Freelance Work Legal Status in the USA

Freelance work legal status in the USA is defined by a complex interplay of federal tax law, state-specific regulations, and court-established common law tests. As a rapidly growing segment of the economy, how can freelancers navigate their legal obligations and protect their rights? What is the difference between an independent contractor and an employee, and why does this distinction carry significant legal and financial consequences? This definitive guide for 2026 clarifies the current legal landscape, outlining the top strategies for compliance, structuring your business, and understanding your entitlements. Mastering these rules is not just about legality—it’s foundational to sustainable freelance success.

What Defines the Legal Status of a Freelancer in the USA?

At its core, the legal status of a freelancer is that of an independent contractor or self-employed individual, not an employee. This classification is governed by a multi-factor test. How does the government determine if you are truly a freelancer? The Internal Revenue Service (IRS) uses a common law test focusing on behavioral control, financial control, and the relationship of the parties. Key questions include: Do you control how and when the work is done? Do you provide your own tools and incur business expenses? Is the work temporary or project-based versus permanent? Misclassification—where a business treats an employee as a freelancer—is a serious legal issue with penalties. For freelancers, maintaining clear boundaries that demonstrate independence is the best way to solidify your legal status.

How Should Freelancers Legally Structure Their Business?

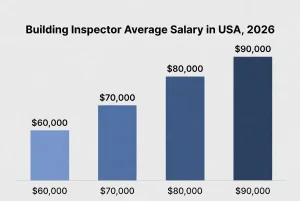

Choosing the right business structure is a critical first legal step. Which structure is best for your freelance work? The options primarily include Sole Proprietorship, Limited Liability Company (LLC), and S-Corporation. What is the difference between them? A Sole Proprietorship is the default, simplest, and most common. You and your business are legally the same entity, meaning personal assets are at risk from business liabilities. Forming an LLC is a top recommendation for most freelancers as it provides a legal shield between personal and business assets, protecting your home and savings. An S-Corp can offer tax advantages for higher-earning freelancers (typically over $60,000-$80,000 in annual profit) by allowing you to pay yourself a “reasonable salary” and take additional profits as distributions, potentially reducing self-employment taxes. How can you decide? Consulting with a small business attorney or CPA in 2026 is the most reliable way to choose based on your specific income and risk profile.

What Are the Federal Tax Obligations for Freelancers?

Freelancers have distinct tax responsibilities. How much will you pay? You are responsible for paying self-employment tax (currently 15.3% for Social Security and Medicare) on your net earnings, in addition to federal income tax. When are taxes due? Unlike employees with withholdings, freelancers must make estimated quarterly tax payments to the IRS (and often their state) in April, June, September, and January. Failure to do so can result in underpayment penalties. What can you deduct? The pros and cons of freelancing include the ability to deduct legitimate business expenses—home office costs, software, equipment, internet, marketing, and professional development—which significantly lower taxable income. Meticulous record-keeping is non-negotiable. Using accounting software or hiring a tax professional familiar with freelance work is one of the best ways to ensure compliance and optimize deductions.

How Do State and Local Laws Impact Freelance Work?

Beyond federal law, state and municipal regulations create a varied patchwork. Which states have the most freelance-friendly laws? States like Texas, Florida, and Nevada are known for favorable business and tax climates. Conversely, states like California have stringent tests for contractor classification (like the ABC test under Assembly Bill 5 and its subsequent amendments) and may require specific registrations. What should you be aware of locally? Many cities require a business license or permit to operate, even from a home office. Some, like New York City, have specific freelancer protection laws that mandate written contracts and timely payment. How can you stay compliant? Research the requirements in your city and state, and consider forming your LLC in a business-friendly state if it aligns with your long-term strategy, though you will likely still need to register as a “foreign entity” to operate in your home state.

What Legal Contracts Do Freelancers Need?

A handshake agreement is insufficient. What are the essential contracts for freelancers? A robust Independent Contractor Agreement is paramount. It should clearly define the scope of work, deliverables, payment terms, deadlines, intellectual property (IP) ownership, and confidentiality. Why is IP ownership a critical clause? Without explicit terms, clients may dispute who owns the work product. How can you ensure payment? Include late fees, a kill fee for canceled projects, and specify that you retain ownership until full payment is received. Other key documents include a Privacy Policy if you collect data on a website, and Terms & Conditions for your services. Using a template from a reputable legal service or investing in an attorney to draft a master agreement is worth the upfront cost to prevent costly disputes.

What Are the Top Legal Mistakes Freelancers Make?

Avoiding common pitfalls is crucial for legal safety. What should you never do?

-

Working Without a Contract: This leaves you vulnerable to non-payment and scope creep.

-

Commingling Personal and Business Finances: Using one bank account blurs the legal line and complicates tax filing, potentially jeopardizing liability protection from an LLC.

-

Ignoring Quarterly Taxes: This leads to a large, unexpected tax bill and penalties from the IRS.

-

Misunderstanding Copyright Law: Assuming you automatically retain copyright to your creative work. You must specify transfer or licensing in your contract.

-

Failing to Secure General Liability or Professional Liability (E&O) Insurance: This protects you from claims of negligence, errors, or omissions that could financially ruin your business.

How often do these mistakes occur? Extremely frequently among new freelancers. A proactive, professional approach from day one is the best way to build a resilient practice.

Table: Freelancer Legal Status – Key Obligations & Considerations

| Area | Key Obligation / Consideration | Deadline / Action Item | Governing Body / Law |

|---|---|---|---|

| Federal Tax Status | File as self-employed; pay Self-Employment Tax & Income Tax. | Quarterly Estimated Payments (Apr, Jun, Sep, Jan); Annual Return (Apr 15). | Internal Revenue Service (IRS) |

| Business Structure | Choose and formally register (if LLC or Corp). | File formation documents with state. | State Secretary of State |

| State/Local Compliance | Obtain business license/tax permit; register for state taxes. | Varies by jurisdiction; often annually. | State Dept. of Revenue; City Clerk |

| Contract Law | Use written agreements for all client engagements. | Before commencing any work. | State Contract Law |

| Intellectual Property | Define ownership of work product in contract. | Specified within client contract. | U.S. Copyright Act; Contract Terms |

| Insurance | Obtain General Liability & E&O/Professional Liability insurance. | Before engaging with clients. | Private Insurance Providers |

Can Freelancers Legally Receive Employee Benefits?

Generally, no. What is the difference between a freelancer and an employee regarding benefits? Employees receive benefits like health insurance, retirement plans (401k), paid leave, and workers’ compensation from their employer. As a freelancer, you are responsible for sourcing and funding these yourself. How can you navigate this? You can purchase individual health insurance through the Affordable Care Act marketplace, set up a Solo 401(k) or SEP IRA for retirement (which offer excellent tax advantages), and budget for your own “paid” time off. The pros and cons are clear: you have more freedom but also more personal responsibility for your safety net.

How Are Freelancer Disputes and Non-Payment Handled Legally?

When a client doesn’t pay, what are the best ways to resolve it? Start with your contract’s late fee and dispute resolution clauses. How many steps should you take before legal action? First, send polite reminders and a formal demand letter. If that fails, options include:

-

Small Claims Court: For debts under the state limit (typically $5,000-$15,000). It’s designed for non-lawyers.

-

Mediation/Arbitration: If specified in your contract.

-

Hiring a Collections Agency or Attorney: For larger sums, though they take a percentage.

How long does the process take? Small claims can take months. The best practice is always proactive: require deposits for new clients and use milestone payments for large projects to mitigate risk.

Frequently Asked Questions (FAQs)

1. Do I need a business license to freelance in the USA?

It depends on your location. There is no federal freelance license, but most cities and counties require a general business license or permit to operate. Some states require a state-level business registration. Always check with your local city clerk and state revenue department.

2. What is the legal difference between a freelancer and an independent contractor?

There is no legal difference; the terms are interchangeable. Both describe a self-employed individual hired to perform specific services for a client under terms defined in a contract. The key legal distinction is between being an “independent contractor” (freelancer) and an “employee.”

3. As a freelancer, am I legally required to have a written contract?

While not universally required by statute (except in places like NYC under its Freelance Isn’t Free Act), it is a critical legal best practice. A written contract is your primary enforcement tool for payment, scope, and intellectual property rights. Operating without one is highly risky.

4. Can I be sued personally as a freelancer?

Yes, if you operate as a sole proprietor. In a sole proprietorship, you and your business are one legal entity, so your personal assets (home, car, savings) are at risk. Forming an LLC or corporation creates a separate legal entity that can shield your personal assets from business-related lawsuits, provided you maintain proper corporate formalities.

5. How do I legally handle sales tax as a freelancer?

It depends on what you sell and where. If you sell tangible goods, you likely need to collect and remit sales tax in states where you have “nexus.” For most service-based freelancers, sales tax does not apply. However, digital products and certain services are taxable in some states. This is a complex area where consulting with a tax professional is advised.

6. Is it legal to freelance while on a visa like H-1B, F-1, or L-1?

Generally, it is not legal. Most U.S. work visas are employer-specific and do not permit self-employment or freelance work for other companies. Engaging in unauthorized freelance work can lead to visa revocation and deportation. Individuals on these visas must seek specific authorization or change their immigration status before freelancing legally.

7. What legal records am I required to keep as a freelancer?

You are legally required to keep records that support your income and deductions for at least three years from your filing date (longer in some cases). This includes invoices, receipts, bank statements, contracts, and mileage logs. Good record-keeping is essential for tax audits and legal protection.

Disclaimer: The information provided in this article is for general educational and informational purposes only and does not constitute legal, tax, or financial advice. Laws and regulations concerning freelance work vary by federal, state, and local jurisdictions and are subject to change. You should consult with a qualified attorney, CPA, or tax advisor for advice specific to your individual circumstances and business.

Keywords: freelance work legal status, independent contractor laws USA, self-employed legal requirements, freelance taxes 2026, how to start freelancing legally, freelance business license, LLC vs sole proprietorship, freelance contract template, freelancer rights, misclassification employee vs contractor