Insurance Claim Handler Salary in USA, 2026

Insurance Claim Handler salaries in the United States vary significantly based on experience, location, and specialty. As of 2026, what is the earning potential for professionals in this critical role? How does geographical location impact pay, and what are the career progression prospects? This comprehensive analysis breaks down the latest salary data, state-by-state comparisons, and the key factors that determine compensation in the insurance claims sector.

What Is the National Average Salary for an Insurance Claim Handler in 2026?

How much can you expect to earn as an Insurance Claim Handler in the current market? According to aggregated data from 2026, the average annual salary for this role across the United States is $42,657. What is the equivalent hourly rate? This translates to approximately $21.59 per hour. However, this median figure represents a wide spectrum. Where do most salaries fall? Entry-level positions, typically requiring less than one year of experience, start around $37,440 per year. On the other end of the scale, the top 10% of most experienced workers can make up to $97,122 annually. This vast range highlights the importance of specialization, tenure, and performance in this field.

How Do Insurance Claim Handler Salaries Vary by State?

Which states offer the highest and lowest compensation for claim handlers? Geographic location is one of the most significant factors influencing pay, often tied to the cost of living, state insurance regulations, and industry hubs.

Top-Paying States (2026 Data):

-

New Mexico: $115,468

-

Louisiana: $49,248

-

New York: $45,046

-

Connecticut: $44,444

-

Maryland: $42,911

Lower-Paying States (2026 Data):

-

South Carolina: $34,024

-

Mississippi: $35,100

-

Tennessee: $35,296

-

Montana: $35,360

-

South Dakota: $35,360

What is the difference between states like New Mexico and the national average? The exceptionally high average in New Mexico is likely an anomaly driven by a low number of reported salaries for senior or specialized roles, rather than a true market standard. For more reliable comparisons, look to established insurance centers like New York, Connecticut, and Illinois.

What Factors Most Influence an Insurance Claim Handler’s Pay?

Beyond location, what are the key drivers that determine salary potential? Several variables can cause significant pay differentials.

-

Experience & Seniority: This is the primary factor. A handler with 5+ years of experience, especially in complex claims (liability, catastrophe, workers’ compensation), can earn 50-100% more than an entry-level adjuster.

-

Type of Insurance: Which specialties pay more? Handlers in commercial lines, professional liability, and cyber insurance typically earn more than those in standard auto or property claims.

-

Employer Type: Working for a major national carrier often provides higher base salaries and better benefits compared to smaller regional agencies or third-party administrators (TPAs).

-

Designations & Education: Holding professional certifications like the Associate in Claims (AIC) or Chartered Property Casualty Underwriter (CPCU) can lead to promotions and salary increases.

-

Performance Metrics: Many roles include bonuses or incentives based on claim closure rates, customer satisfaction scores, and audit results.

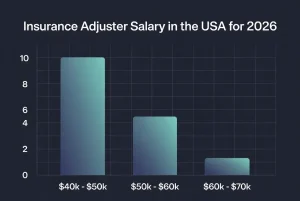

What Is the Career Path and Salary Progression for a Claim Handler?

How much can your salary grow over a career? The trajectory from entry-level to senior roles shows substantial financial growth.

-

Entry-Level / Claims Adjuster Trainee: $37,440 – $45,000. Focuses on straightforward claims under supervision.

-

Experienced Claim Handler / Specialist: $45,000 – $65,000. Manages a full caseload independently, often specializing in a line of business.

-

Senior Claim Handler / Complex Claims Specialist: $65,000 – $85,000. Handles high-value, litigated, or technically complex claims.

-

Team Lead / Supervisor / Manager: $75,000 – $97,122+. Manages a team of handlers, oversees operations, and handles escalations.

Is it worth pursuing management? Moving into leadership is the best way to break past the ceiling for individual contributor roles, with potential to exceed $100,000 with further experience.

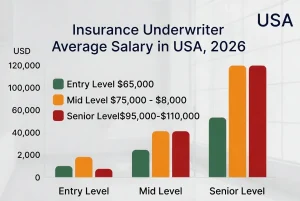

How Do Insurance Claim Handler Salaries Compare to Related Roles?

What is the difference between a Claim Handler and other common insurance positions? Understanding the broader salary landscape helps in career planning.

| Related Job Title | Average Annual Salary (2026) | Primary Focus | Typical Requirement Difference |

|---|---|---|---|

| Insurance Claims Adjuster | ~$45,000 – $60,000 | Often field-based investigation; similar core function. | May require more travel for on-site inspections. |

| Claims Examiner | ~$50,000 – $70,000 | Reviews complex or questionable claims for payment approval; more analytical. | Often requires more experience and deeper policy knowledge. |

| Underwriter | ~$65,000 – $85,000 | Assesses risk before issuing policies; a pre-claim function. | Different skill set focused on risk assessment and pricing. |

| Insurance Sales Agent | ~$50,000 – $75,000+ | Focus on acquiring new clients; income often heavily commission-based. | Revenue-generating vs. operational role. |

What Are the Future Job Outlook and Earning Potential Trends?

What is the projected demand for Insurance Claim Handlers? The U.S. Bureau of Labor Statistics groups this role with claims adjusters and examiners, projecting decline in employment from 2022 to 2032. However, this masks a key trend: while automation may reduce simple claims, there will be sustained demand for handlers who can manage complex cases, navigate regulations, and provide empathetic customer service. Which skills will be most valuable? Expertise in cybersecurity, data analytics, and litigation management will command premium salaries. Geographic regions prone to climate-related disasters will also see sustained demand for catastrophe claim specialists.

How Can You Increase Your Salary as an Insurance Claim Handler?

What are the best ways to boost your earning potential in this career?

-

Specialize: Move away from high-volume, low-complexity claims into niches like workers’ compensation, liability, or professional lines.

-

Get Certified: Pursue industry-recognized designations (AIC, SCLA, CPCU) to validate your expertise.

-

Develop Soft Skills: Excelling in negotiation, communication, and customer service can lead to better performance reviews and bonuses.

-

Consider Relocation: Targeting roles in states with higher averages or in major metropolitan insurance hubs can be beneficial.

-

Transition to Management: Seek out team lead opportunities to shift from individual productivity to leadership, which has a higher pay scale.

Frequently Asked Questions (FAQs)

1. What is the difference between a Claim Handler and a Claims Adjuster?

The terms are often used interchangeably. However, “Handler” can imply a more desk-based, administrative management of the claim process from start to finish, while “Adjuster” may specifically refer to the professional who investigates, evaluates, and negotiates the settlement. In practice, many professionals perform both roles.

2. How much would I take home after taxes on a $42,657 salary?

Your net pay depends on your state of residence, filing status, and deductions. As a very rough estimate, a single filer with no dependents in a state with average taxes might take home approximately $2,600 to $2,800 per month. Using a reliable salary tax calculator for your specific location is essential for an accurate figure.

3. Is the salary for an Insurance Claim Handler typically commission-based?

No, most Insurance Claim Handler positions are salaried or hourly roles, sometimes with performance-based bonuses or incentives. Their compensation is not usually tied to sales commissions, unlike insurance sales agents.

4. What is the best state to work in as an Insurance Claim Handler for high pay?

While New Mexico shows an outlier average, for stable, high-paying opportunities, focus on states with major insurance company headquarters and a high cost of living. Connecticut (home to many insurance carriers), New York, and Illinois are traditionally strong markets for insurance professionals.

5. Do I need a degree to become an Insurance Claim Handler?

While not always mandatory, most employers prefer candidates with at least a bachelor’s degree. Relevant fields include business, finance, or criminal justice. Strong interpersonal skills and attention to detail are often equally important. Many companies provide extensive on-the-job training.

6. Are there opportunities for remote work as a Claim Handler?

Yes, the industry has seen a significant shift towards hybrid and remote work models, especially for roles that involve desk-based review and phone communication. However, positions requiring field inspections (often called Field Adjusters) will necessitate travel.

Disclaimer: The salary data, figures, and career advice provided in this article are based on aggregated market data from 2026 and are for general informational purposes only. Actual salaries can vary widely based on individual qualifications, specific employer, economic conditions, and geographic location. This information should not be considered a guarantee of any specific salary offer or career outcome.

Keywords: insurance claim handler salary, claims adjuster salary 2026, average insurance salary, claim handler jobs, insurance careers, claims examiner, property and casualty insurance jobs, how much do claim handlers make, insurance industry salary, entry-level insurance jobs