Insurance Agent Salary in the United States, 2026

Insurance Agent salary in the United States is a dynamic figure, heavily influenced by commission structures, experience, geographic location, and specialization. As we look at the data for 2026, what is the true earning potential for agents across the country? How much can a new agent expect to make, and what are the top strategies to reach the higher end of the pay scale? This comprehensive analysis breaks down the national averages, state-by-state variations, and the key factors that determine an agent’s income, providing a clear roadmap for both aspiring and current professionals in the insurance industry.

What Is the Average Base Salary for an Insurance Agent in the USA?

Understanding the baseline is crucial for career planning. How much does a typical Insurance Agent make annually? Based on aggregated salary data from 2026, the average base salary for an Insurance Agent in the United States is $46,500 per year. When broken down hourly, this equates to approximately $23.53 per hour. However, this median figure tells only part of the story, as the range is exceptionally wide. What is the difference between entry-level and top-earning agents? Entry-level positions typically start around $36,540 per year, while the most experienced and successful agents can earn upwards of $112,360 per year. This vast disparity highlights that this is primarily a commission-driven role where performance directly dictates earnings.

Which US States Pay the Highest Salaries for Insurance Agents?

Geographic location is one of the most significant factors influencing an Insurance Agent’s income. Where should an agent consider working to maximize their base salary potential? The data for 2026 reveals clear leaders, primarily concentrated in the Northeast and certain coastal states.

What are the top 5 highest-paying states?

-

Connecticut: Leading the nation with an average salary of $60,365.

-

Delaware: Offering an average of $56,000.

-

Maryland: Close behind at $54,477.

-

California: At $54,068, despite a high cost of living.

-

Massachusetts: Rounding out the top five at $53,948.

How far does the regional advantage extend? States like New York, New Jersey, and Washington also offer above-national-average wages, indicating stronger markets or higher premium values in those regions. Conversely, states like New Mexico and Montana report averages closer to the entry-level range, suggesting different market dynamics or saturation levels.

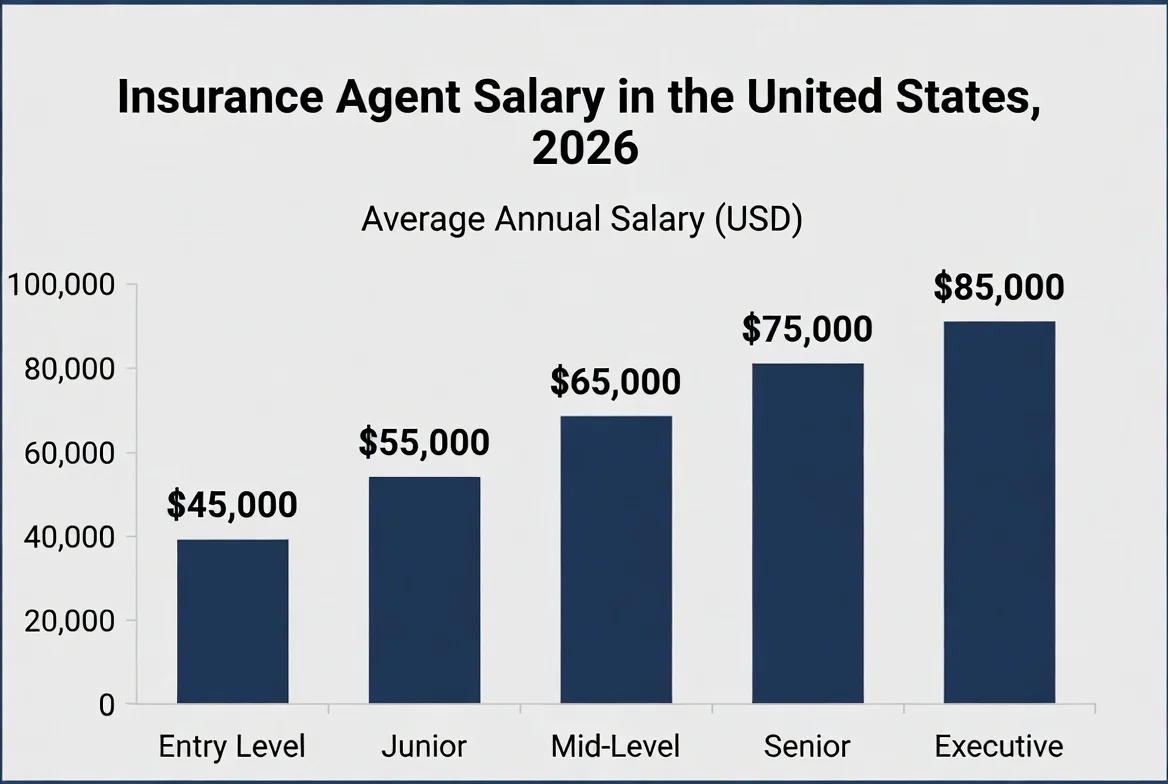

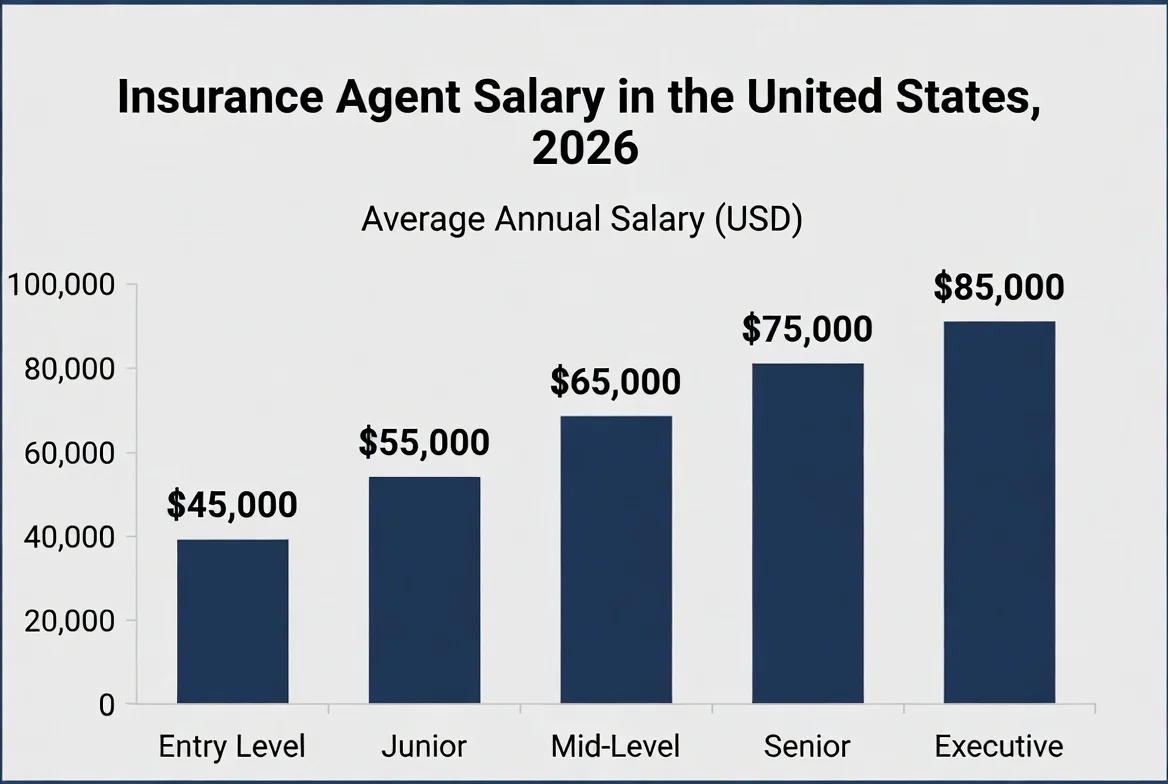

How Do Experience and Specialization Impact an Agent’s Earnings?

Base salary is just the foundation. What is the best way for an Insurance Agent to increase their total compensation? The answer lies in experience, niche specialization, and the type of insurance sold.

First, experience is directly correlated with income. A new agent will likely rely heavily on a modest base salary while building their book of business. Within 3-5 years, successful agents often see their commission income surpass their base pay. By 10+ years, top performers with strong client retention and referral networks can reach the peak earning brackets.

Second, specialization is a powerful earnings lever. What is the difference between a general agent and a specialized one? Agents who focus on high-value, complex lines like commercial insurance, professional liability, or life and financial planning typically earn significantly more than those selling standard auto or home policies. Earning advanced designations (e.g., CLU, ChFC, CPCU) also commands higher trust and justifies higher premiums and commissions.

What Are the Primary Compensation Structures for Insurance Agents?

Understanding how you get paid is key. How does the typical Insurance Agent compensation model work? There are generally three primary structures:

-

Salary-Only: Rare, typically for customer service roles or trainee positions.

-

Commission-Only: Common for independent agents and brokers. Earnings are uncapped but come with higher risk.

-

Salary + Commission (or Bonus): The most common model for captive agents (those representing one company, like State Farm or Allstate). This provides financial stability while offering unlimited upside.

Which structure offers the highest potential? For entrepreneurial agents willing to assume risk, a commission-only model at a brokerage with competitive commission rates (often 50-90% of the premium commission) can be extraordinarily lucrative. How much can a commissioned agent make? It’s not uncommon for top producers in this model to earn $150,000 to $500,000+ annually.

What Skills and Strategies Are Crucial for Maximizing Income?

Beyond the structure, success requires specific skills. What are the best ways to ensure consistent high earnings as an Insurance Agent?

First, master sales and relationship-building. This is fundamentally a sales role. The ability to prospect, nurture leads, and close policies is paramount.

Second, develop deep product knowledge. Clients trust experts. Understanding policy nuances allows you to provide better coverage and justify your value.

Third, leverage technology. Using Customer Relationship Management (CRM) systems efficiently, embracing digital marketing for lead generation, and utilizing comparison tools are no longer optional.

Fourth, build a niche. As noted, specializing in a specific demographic (e.g., small business owners, physicians, retirees) or product line allows you to become the go-to expert, reducing competition and increasing closing rates.

How long does it take to build a profitable book? Most agents agree it takes 2-3 years of consistent effort to build a sustainable, renewing client base that provides stable annual commission income.

What Is the Career Outlook for Insurance Agents in 2026 and Beyond?

Is it worth pursuing a career as an Insurance Agent in the current economy? The outlook remains stable. How many jobs are projected? The U.S. Bureau of Labor Statistics projects steady demand, as insurance is a constant need. While direct purchase online poses a challenge for simple policies, it increases the value of agents for complex coverage, risk management, and personalized advice—areas that cannot be easily automated.

The pros and cons of the career are clear:

-

Pros: Unlimited earning potential, flexibility, the opportunity to be your own boss (as an independent agent), and a career built on helping people.

-

Cons: Income can be irregular, especially at first. The work requires resilience in the face of rejection, and it can be highly competitive.

Table: Insurance Agent Salary Snapshot by State (2026)

| State | Average Annual Salary | Key Notes |

|---|---|---|

| Connecticut | $60,365 | Highest in the nation, strong in financial and commercial lines. |

| California | $54,068 | High cost of living, but large, diverse market with high premium values. |

| Texas | $45,454 | Large population and business base offers vast opportunity for volume. |

| Florida | $43,671 | High demand for property insurance (despite market challenges), large retiree population. |

| Illinois | $45,689 | Major hub for commercial insurance in Chicago. |

| National Average | $46,500 | Median benchmark for all experience levels and states. |

Frequently Asked Questions (FAQs)

1. What is the single biggest factor in an Insurance Agent’s salary?

Performance, measured in written premiums and policy sales, is the ultimate determinant. While location and company play a role, an agent’s drive, skill, and work ethic directly control their commission earnings, which make up the bulk of income for most successful agents.

2. How much does a new, entry-level Insurance Agent make?

In 2026, entry-level positions start around $36,540 per year. This often includes a base salary or stipend to help during the training and client-building phase, which may last 12-24 months.

3. What’s the difference between a captive agent and an independent agent?

A captive agent works for one insurance company (e.g., Allstate, Farmers). They typically receive stronger training, marketing support, and a base salary plus commission. An independent agent or broker represents multiple companies. They have more flexibility to find the best policy for a client and usually work on a commission-only basis with higher potential earnings but no base salary.

4. How do commissions work for life insurance vs. property & casualty?

Life insurance and annuities often pay a high first-year commission (e.g., 50-100% of the first year’s premium) and smaller renewal commissions (e.g., 2-5%). Property & Casualty (auto, home) insurance typically pays a lower but steadier commission (e.g., 10-15%) that renews annually as long as the policy stays in force, building a recurring income stream.

5. Can you make a lot of money as an Insurance Agent?

Absolutely. While the average is modest, the career offers one of the highest uncapped earning potentials in the professional services sector. Top-producing agents, especially those in commercial lines or financial planning, regularly earn mid-six to seven-figure incomes through a combination of new business and renewals.

6. What are the main challenges in this career?

The primary challenges are lead generation, dealing with rejection, the pressure of variable income, and navigating complex and changing regulations. Success requires self-discipline, persistence, and continuous learning.

7. What licenses are required to become an Insurance Agent?

You must obtain a license in each state where you plan to sell. This involves pre-licensing education, passing a state exam (for lines like Life & Health or Property & Casualty), and undergoing a background check. Continuing education is required to maintain the license.

Disclaimer: The salary data, averages, and compensation information provided in this article are based on aggregated sources for the year 2026 and are intended for general informational purposes only. Actual earnings for Insurance Agents vary widely based on individual performance, commission structures, specific employer, geographic location, market conditions, and economic factors. This information should not be considered a guarantee or projection of actual income.

Keywords: insurance agent salary, how much does an insurance agent make, insurance agent salary 2026, average insurance agent income, insurance sales commission, independent insurance agent salary, captive agent salary, highest paying states for insurance agents, insurance agent career, insurance job outlook