Financial Services Agent Average Salary in USA, 2026

Financial Services Agent salaries in the United States represent a dynamic and commission-influenced career path within the financial sector. As we look at the data for 2026, what is the true earning potential for agents, and how do factors like location, experience, and specialization dramatically shift these figures? This comprehensive analysis breaks down the national averages, state-by-state comparisons, and related roles to give you a clear, actionable picture of compensation in this field.

What Is the Average Salary for a Financial Services Agent in the USA?

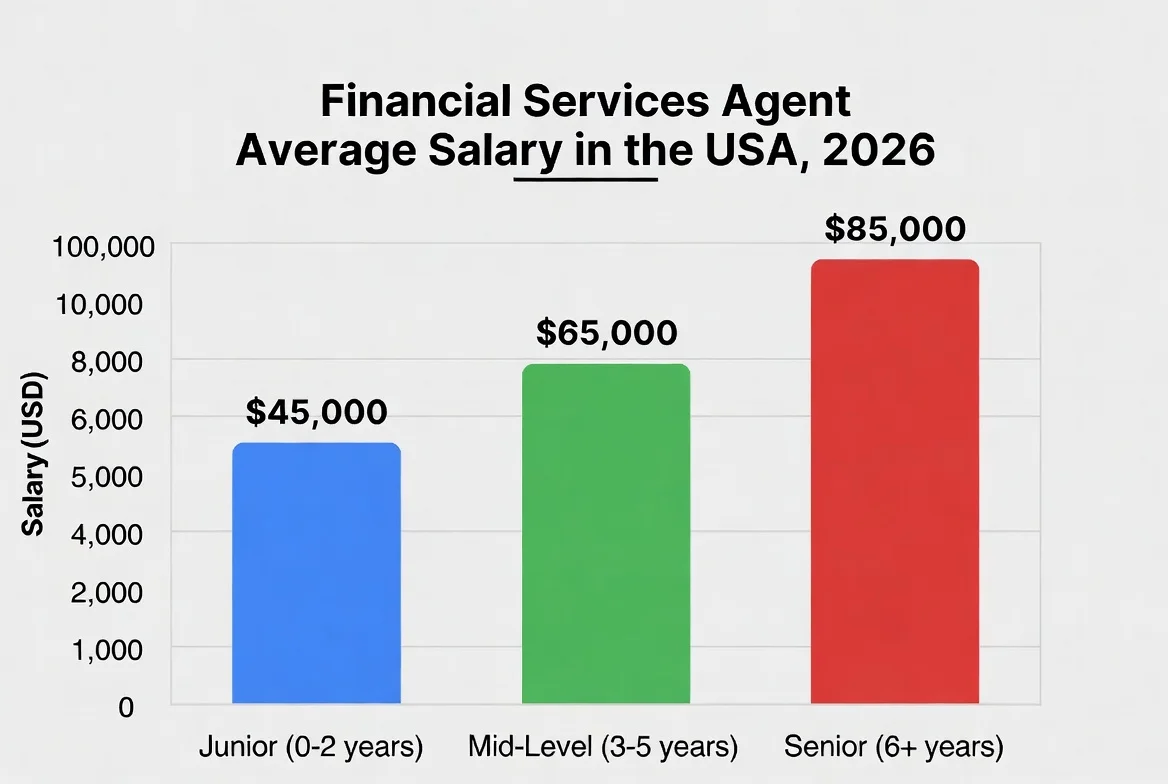

Why is there such a wide range in reported earnings for Financial Services Agents? The difference between base salary and total compensation, which often includes commissions and bonuses, is the key factor. Based on aggregated 2026 salary data, the average annual salary for a Financial Services Agent in the United States is $50,262. This translates to an average hourly rate of approximately $25.44. However, this median figure only tells part of the story. How much can entry-level versus experienced agents expect? Entry-level positions typically start around $37,243 per year, while the top 10% of most experienced and high-performing agents can earn upwards of $103,698 annually. This significant range highlights the performance-driven nature of the role.

How Does Location Impact a Financial Services Agent’s Salary?

Which states offer the highest pay for Financial Services Agents, and what drives these geographic disparities? Compensation is heavily influenced by the cost of living, the concentration of financial firms, and state-specific market demands. The top-paying states in 2026 are predominantly in the Northeast and West Coast:

-

New York: $74,083

-

California: $72,114

-

New Jersey: $71,998

-

Connecticut: $71,750

-

Maryland: $68,769

Conversely, what are the pros and cons of working in lower-paying states? While salaries in states like North Dakota ($38,021) or Hawaii ($37,773) are lower, they may coincide with a different cost of living or niche market opportunities. The best way to evaluate an offer is to consider the local purchasing power and career growth potential specific to that region.

What Are the Key Factors That Influence Earnings Potential?

Beyond location, what are the best ways for a Financial Services Agent to increase their income? Several controllable factors have a direct impact:

-

Licensing and Specialization: Holding Series 7 (General Securities Representative) and Series 66 or 65 (Investment Advisor) licenses is often a baseline. Specializing in areas like retirement planning, estate planning, or commercial insurance can command higher fees.

-

Commission Structure: Understanding your firm’s compensation plan is critical. What percentage of assets under management (AUM) or product premiums do you earn?

-

Experience and Client Book: As you build a robust and loyal client portfolio, recurring revenue from AUM and renewals creates income stability. How long does it typically take to build a sustainable book? Often 3-5 years.

-

Employer Type: Are you working for a large wirehouse, a regional bank, an independent broker-dealer, or as part of an insurance agency? Each has a different pay scale and support system.

How Does This Role Compare to Related Financial Positions?

What is the difference between a Financial Services Agent and other similar titles? Understanding the compensation landscape of related roles provides context for career progression.

| Related Job Title | Average Annual Salary (2026) | Primary Focus | Typical Requirements |

|---|---|---|---|

| Financial Consultant | $85,000 | Holistic financial planning & investment management. | Series 7, 66, often a bachelor’s degree. |

| Relationship Manager | $93,284 | Managing high-net-worth client portfolios & relationships. | Extensive experience, advanced licenses (e.g., CFP). |

| Personal Banker | $49,733 | Consumer banking products (accounts, loans, basic investments). | Often requires Series 6 or 7, less emphasis on complex planning. |

| Financial Services Representative | $45,916 | Entry-level sales and service for financial products. | May be unlicensed or hold a state insurance license. |

| Account Executive | $88,750 | Often focused on commercial/business financial products. | Strong sales background, industry-specific knowledge. |

As shown, advancing from an agent to a consultant or manager typically involves gaining expertise, higher-level licenses, and a proven sales track record.

What Is the Career Path and Growth Outlook for This Role?

Where can a career as a Financial Services Agent lead? The role is commonly a gateway into the financial services industry. A typical path might involve starting as a Financial Services Representative, becoming a licensed Agent, then progressing to a Financial Advisor/Consultant, and eventually to a Senior Advisor or Portfolio Manager. How fast is the job market growing? The U.S. Bureau of Labor Statistics projects average growth for securities, commodities, and financial services sales agents, with demand tied to the overall health of the economy and aging population seeking retirement advice. Success in this field is less about vacancy rates and more about an individual’s ability to attract and retain clients.

What Are the Essential Skills for Maximizing Income?

Which skills are most critical for a high-earning Financial Services Agent? Technical knowledge is just the entry ticket. The top skills that drive income are:

-

Sales and Persuasion: The core of the role is acquiring clients and selling suitable products.

-

Relationship Building: Long-term success depends on trust and client retention.

-

Financial Acumen: Deep understanding of markets, tax implications, and product details.

-

Communication: Clearly explaining complex concepts to clients.

-

Resilience: The role often involves significant rejection, especially in the early years.

Developing these skills is arguably more important than the initial salary figure.

Frequently Asked Questions (FAQs)

1. What does a Financial Services Agent do?

A Financial Services Agent sells and services financial products such as insurance policies (life, health, property), annuities, and sometimes basic investment products. They assess client needs, explain options, and help clients apply for coverage or investments, earning primarily through commissions.

2. Is the salary mostly commission-based?

Yes, compensation is often heavily weighted toward commissions and bonuses, especially after an initial training period that may include a base salary or draw. The median figure of $50,262 represents total cash compensation (base + commission) for an average performer.

3. What licenses do I need to become a Financial Services Agent?

At a minimum, you need a state license for each line of insurance you sell (Life & Health, Property & Casualty). To sell securities (stocks, bonds, mutual funds), you must pass the FINRA Series 6 or Series 7 exam and be sponsored by a registered firm.

4. How can I increase my salary as a Financial Services Agent?

The most direct ways to increase earnings are: 1) Obtaining additional licenses (Series 7, 66) to sell more products. 2) Specializing in a lucrative niche like business insurance or retirement plans. 3) Focusing on building long-term client relationships for renewal commissions. 4) Moving to a firm with a more favorable commission grid or support structure.

5. What is the job outlook for Financial Services Agents?

The outlook is competitive but stable. Automation handles simpler transactions, increasing the value of agents who provide complex advice and personalized service. Growth prospects are best for those who can adapt to digital tools while maintaining strong interpersonal connections.

6. Are there opportunities for remote work in this field?

Yes, remote and hybrid models have become more common, especially for client meetings and administrative work. However, building a local network and meeting clients in person can still be a significant advantage, particularly when starting.

Disclaimer: The salary data, figures, and career information presented in this article are for general informational purposes only and are based on aggregated 2026 market data. Actual compensation can vary widely based on an individual’s performance, specific employer, exact location, commission structure, and economic conditions. This information should not be considered a guarantee of any specific salary offer or career outcome.

Keywords: financial services agent salary, average salary financial agent, insurance agent pay 2026, commission based finance jobs, how much do financial agents make, financial services career path, licensed financial representative, salary by state USA, entry level finance salary, financial advisor vs agent