Actuarial Analyst Average Salary in USA, 2026

Actuarial Analyst salaries in the United States represent a critical entry point into the lucrative and intellectually demanding field of actuarial science. As of 2026, what is the true earning potential for these professionals who quantify risk and uncertainty? How do factors like location, experience, and professional exams influence these figures? This comprehensive analysis breaks down the national and state-level salary data, providing a clear picture of the financial landscape for Actuarial Analysts and offering insights into the career path that lies beyond this pivotal role.

What Is the National Average Salary for an Actuarial Analyst in 2026?

Understanding the baseline compensation is the first step in evaluating this career. How much does an Actuarial Analyst make on average across the United States? Based on aggregated salary data from 2026, the national average annual salary for an Actuarial Analyst is $90,000. What is the equivalent hourly rate? This translates to approximately $45.55 per hour. However, this median figure tells only part of the story. What is the difference between entry-level and senior-level pay? Entry-level positions, typically for those with 0-2 years of experience and 1-3 passed actuarial exams, start at an average of $66,244 per year. In contrast, the most experienced workers, often those with several years of experience and multiple exams toward Associateship or Fellowship, can make up to $129,857 per year. This progression highlights the significant financial reward tied to professional development and exam success.

How Does Actuarial Analyst Salary Vary by State in 2026?

Geographic location is one of the most powerful determinants of salary. Which states offer the highest compensation for Actuarial Analysts, and where are the salaries more moderate? The variation is substantial, often reflecting the concentration of insurance companies, consultancies, and financial hubs.

Top-Paying States (Average Annual Salary):

-

Virginia: $100,442

-

Maryland: $99,510

-

Hawaii: $96,300

-

California: $93,370

-

Washington: $93,165

What are the pros and cons of working in a high-salary state? The obvious pro is higher gross income. However, these states often coincide with areas boasting a high cost of living (e.g., California, Hawaii, metropolitan Washington D.C.). The con is that the increased salary may be offset by higher expenses for housing, transportation, and taxes. Conversely, states with lower average salaries may offer a more favorable ratio of income to living costs.

What Are the Key Factors Influencing an Actuarial Analyst’s Salary?

Beyond location, multiple variables impact earning potential. How can you maximize your salary as an Actuarial Analyst? Understanding these levers is crucial.

-

Actuarial Exams Passed: This is the single most important factor. How many exams have you passed? Each passed exam typically comes with a substantial salary increase (often $3,000-$8,000 per exam) and a bonus. Employers invest in analysts who demonstrate commitment to achieving professional credentials (ASA/FSA).

-

Years of Experience: Directly correlated with pay. An analyst with 5 years of experience will command significantly more than one with 1 year, assuming similar exam progress.

-

Industry and Company Size: Which sector pays more? Life insurance, health insurance, property & casualty (P&C) insurance, and consulting all have different pay scales. Large, multinational firms and prestigious consultancies often offer higher base salaries than smaller regional companies.

-

Specialized Skills: Proficiency in specific programming languages (SQL, R, Python, VBA) and advanced data modeling techniques can make a candidate more valuable and justify a higher salary.

How Does the Actuarial Analyst Role Compare to Related Positions?

Contextualizing the salary within the broader job family is essential. What is the difference between an Actuarial Analyst and a fully credentialed Actuary or other analytical roles?

| Job Title | Average Salary (2026) | Primary Focus & Typical Requirements |

|---|---|---|

| Actuary | $151,225 | Fully credentialed (ASA/FSA). Performs high-level pricing, valuation, and risk management. |

| Actuarial Consultant | $95,450 | Often requires several exams. Provides specialized advice to clients, typically in a consulting firm. |

| Data Analyst | $102,413 | Focuses on interpreting data trends across various industries. May not require actuarial exams. |

| Pricing Analyst | $90,000 | Similar compensation level. Focuses on setting product prices, often within insurance or finance. |

| Actuarial Analyst | $90,000 | Entry-to-mid-level role supporting actuaries with data preparation, analysis, and report generation while taking exams. |

The table shows that the Actuarial Analyst role is a foundational, well-compensated step on a path that leads to some of the highest-paying professions in business.

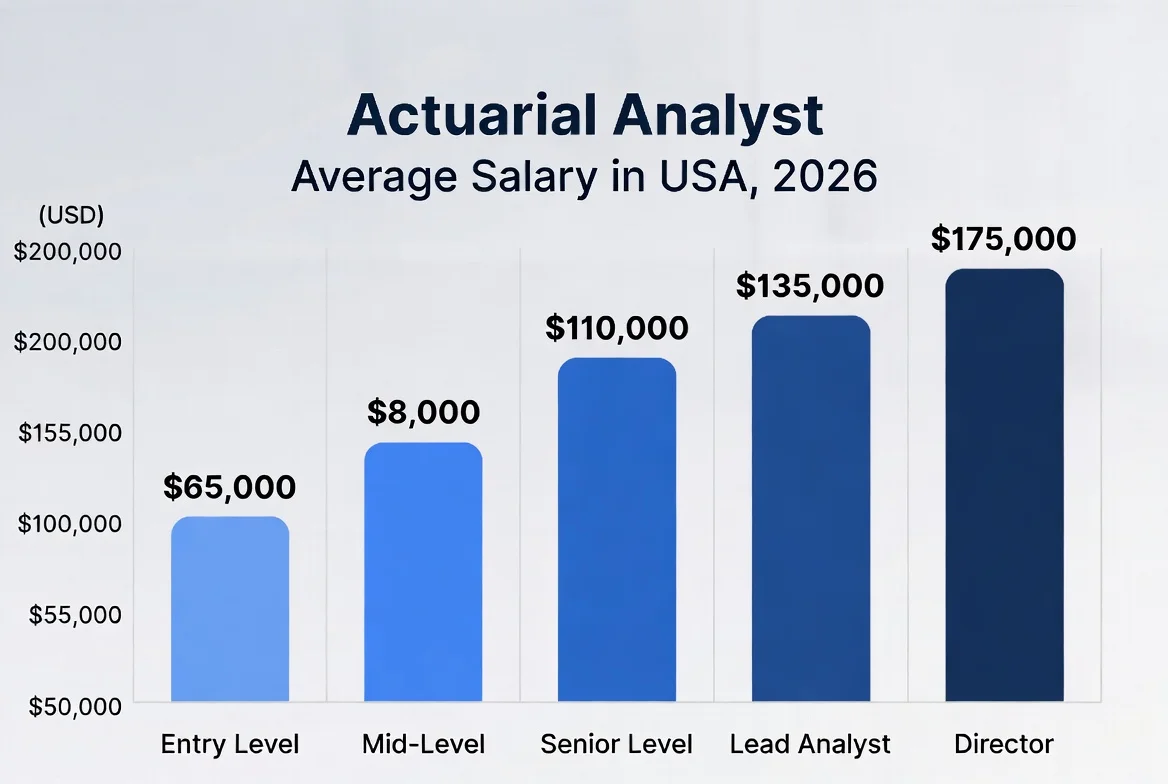

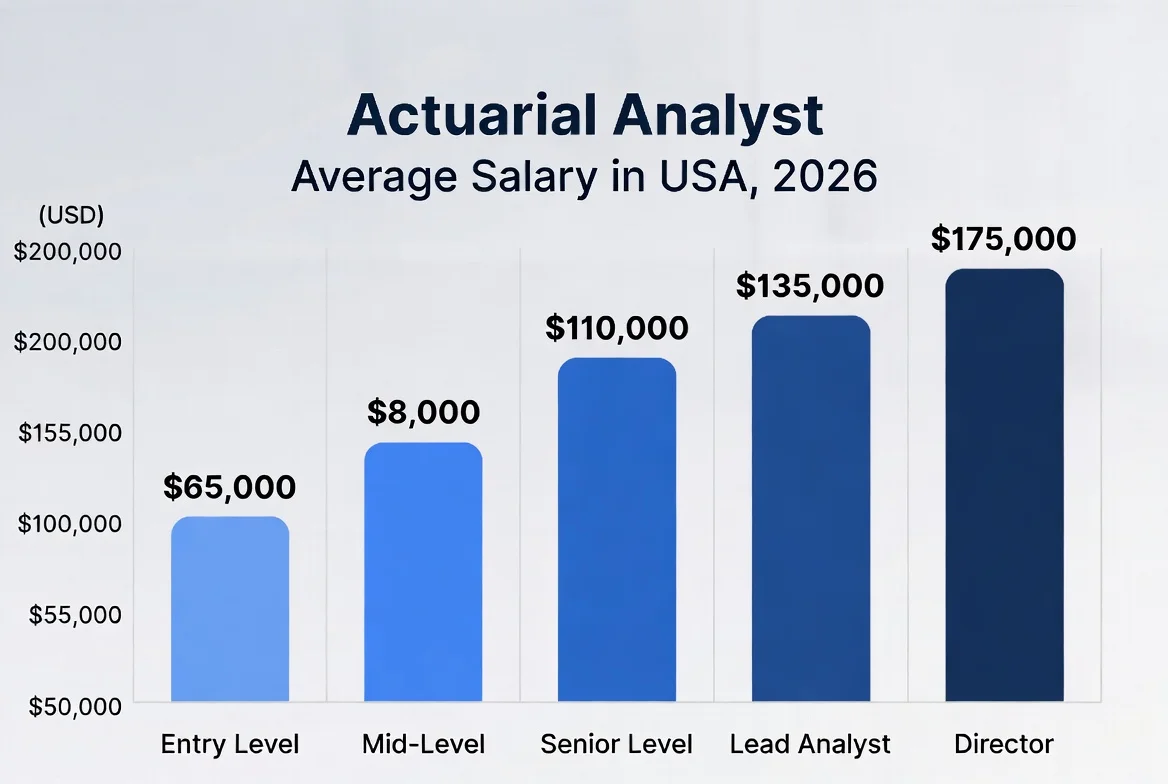

What Is the Career Path and Long-Term Earning Potential?

Where can a role as an Actuarial Analyst lead? The career trajectory is well-defined and financially rewarding. How fast can you progress? The typical path involves starting as an analyst, passing exams, and advancing to Senior Actuarial Analyst, then to Actuary upon credentialing, and eventually to management roles like Chief Actuary or VP of Actuarial Services. With Fellowship (FSA/FCAS), total compensation (including base, bonus, and long-term incentives) can reliably reach into the high hundreds of thousands, and even surpass $500,000 in senior executive roles. Is it worth the rigorous exam process? The long-term financial and professional stability offered by an actuarial career is widely considered to be worth the significant upfront investment in study time and effort.

What Are the Top Skills and Qualifications to Boost Your Salary?

To accelerate earnings, focus on in-demand competencies. What should you prioritize learning?

-

Technical Skills: Advanced Excel, SQL, R, Python, Prophet, Axis, and other actuarial modeling software.

-

Business Acumen: Understanding the specific insurance line (P&C, Life, Health) and its regulatory environment.

-

Communication: The ability to explain complex technical findings to non-technical stakeholders is highly valued and can set you apart for promotions.

-

Exam Progress: Consistent progress on actuarial exams is non-negotiable for major salary jumps.

Frequently Asked Questions (FAQs)

1. What is the single biggest factor in an Actuarial Analyst’s salary?

The number of passed actuarial exams is the most significant and direct driver of salary increases. Employers have clear “exam salary schedules” that outline raises and bonuses for each exam passed.

2. How long does it take to move from an Actuarial Analyst to a credentialed Actuary?

The timeline varies but typically takes 5-10 years of dedicated work and exam study. It requires passing a series of 7-10 rigorous professional exams to achieve Associateship (ASA/ACAS) and further exams for Fellowship (FSA/FCAS).

3. Is the job market for Actuarial Analysts strong in 2026?

Yes, the demand for actuarial professionals remains robust. The best way to gauge this is to look at the consistent hiring by insurance companies, consulting firms, and government agencies. The need to manage financial risk in an uncertain world ensures steady demand.

4. How much does the industry (Life vs. Health vs. P&C) affect starting salary?

There can be variation. As of 2026, consulting and specialized P&C roles often offer slightly higher starting salaries, but the differences are usually marginal compared to the impact of location and exam progress. The best practice is to research specific companies.

5. Do most Actuarial Analyst positions offer support for exams?

Virtually all reputable employers offer a comprehensive study program. This includes paid study hours (typically 100-130 hours per exam), reimbursement for exam fees and study materials, and bonuses for each exam passed.

6. What is the work-life balance like for an Actuarial Analyst?

Balance can be challenging during exam seasons, requiring 15-20 hours of study per week on top of a full-time job. Outside of these periods, the role typically offers a standard 40-45 hour work week, with increased hours during quarterly or year-end reporting cycles.

7. Are remote or hybrid roles common for Actuarial Analysts?

Since 2026, hybrid work models have become very common in the industry. Fully remote positions exist but are less frequent for entry-level analysts, as in-person training and mentorship are highly valued. Experience often grants more flexibility.

Disclaimer: The salary data, figures, and career projections presented in this article are based on aggregated market research and sources available in 2026. They are intended for general informational purposes only. Individual salaries will vary based on a candidate’s unique qualifications, the specific employer, negotiation skills, and economic conditions. This information should not be relied upon as a guarantee of compensation.

Keywords: actuarial analyst salary, actuary salary 2026, average salary for actuarial analyst, entry-level actuary, actuarial science careers, how much does an actuarial analyst make, actuarial exam salary, insurance jobs salary, data analyst vs actuarial analyst, highest paying states for actuaries