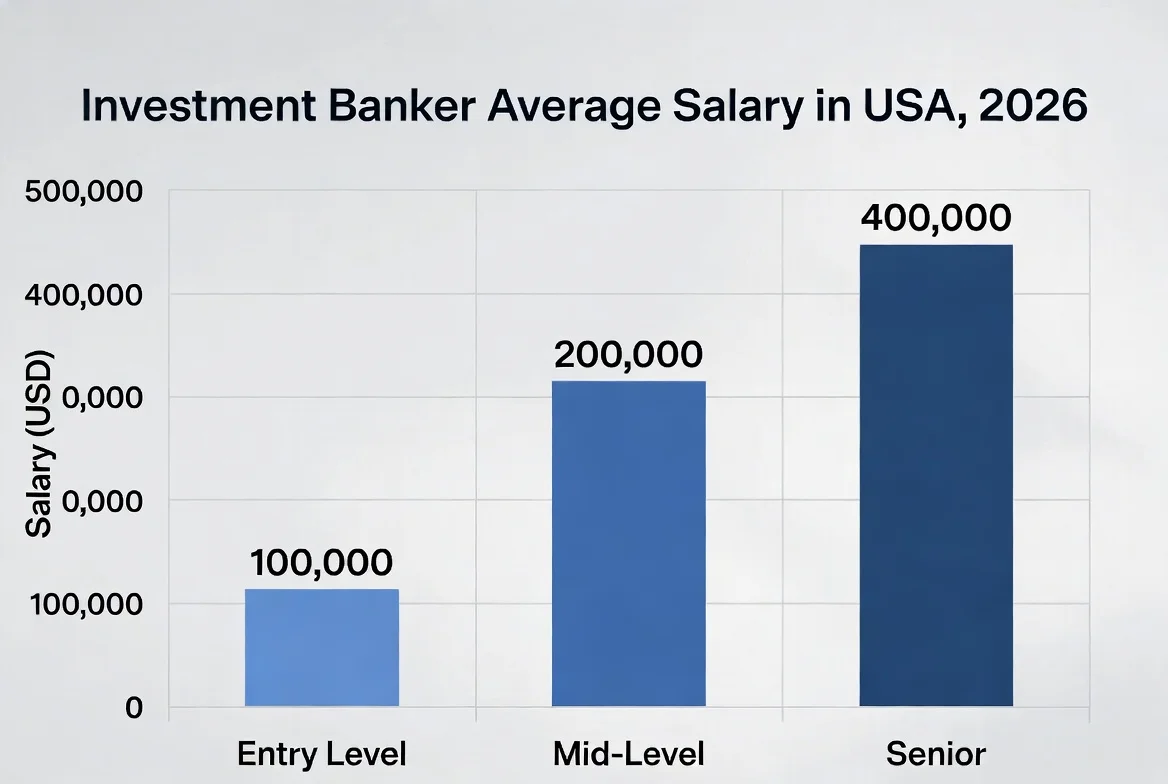

Investment Banker Average Salary in USA, 2026

Investment Banker salaries in the United States are highly variable, reflecting the intense, performance-driven nature of the finance industry. As of 2026, what is the true earning potential for an Investment Banker, and how do factors like experience, location, and firm prestige create a wide spectrum from modest base pay to exceptional total compensation? This comprehensive analysis breaks down the latest salary data, bonus structures, and career pathways to answer the critical question: How much can you realistically expect to make?

What Is the Average Salary for an Investment Banker in the USA?

The reported average base salary for an Investment Banker in the United States is $54,278 per year, which translates to approximately $27.47 per hour. However, this figure is deceptive. Why is there such a stark contrast between this average and the common perception of Wall Street wealth? This base often represents salaries for titles with “banker” in less specialized retail or commercial banking settings. For front-office, bulge-bracket, or elite boutique investment bankers, total compensation—including substantial annual bonuses—is the true metric. How much does total compensation differ? It can multiply the base salary several times over, especially in high-finance hubs.

How Do Experience Levels Affect Investment Banker Pay?

Compensation in investment banking is famously tied to a rigid hierarchy. What is the difference between an Analyst, an Associate, and a Vice President’s pay? Entry-level Analysts (0-3 years) see base salaries starting around $100,000 – $130,000, with bonuses potentially adding 50-100% of that base, bringing total compensation to $150,000 – $250,000+. Associates (3-6 years) can earn a base of $150,000 – $200,000, with bonuses often matching or exceeding their base, leading to totals of $300,000 – $400,000. Vice Presidents and beyond see base salaries climb to $250,000 – $500,000+, with bonuses that can double that figure, especially in a strong deal-making year like 2026.

Which US Cities Pay Investment Bankers the Most?

Location is a paramount factor, with compensation concentrated in major financial centers. Where are the highest salaries found? New York City remains the undisputed epicenter, where total compensation for top performers can be 20-50% higher than the national average for similar roles. Other key hubs include Charlotte (major banking center), Boston, Chicago, and San Francisco (for tech-focused IB). How far does the geographic premium extend? Salaries in non-financial hubs drop significantly, often aligning closer to the reported national average base salary.

What Are the Key Components of an Investment Banker’s Total Compensation?

Understanding the pay structure is crucial. What are the pros and cons of this model? The compensation package is typically split into:

-

Base Salary: A guaranteed annual pay. How much security does it offer? It provides stability but is often a small portion of total pay.

-

Annual Bonus: A performance-based payout, tied to individual, team, and firm profitability. This is where the majority of earnings lie for successful bankers. When is it paid? Usually in the first quarter of the following year (e.g., Q1 2027 for 2026 performance).

-

Signing Bonus: A one-time payment for new hires, especially at the Analyst and Associate levels, which can be substantial.

-

Other Benefits: May include retirement plan contributions, health benefits, and sometimes deferred stock options.

How Does Working for a Bulge Bracket vs. a Boutique Firm Impact Salary?

The type of firm defines your earning trajectory. What is the difference between a bulge bracket and a boutique? Bulge Bracket banks (e.g., Goldman Sachs, JPMorgan Chase, Morgan Stanley) offer the highest base salaries and brand prestige, with very large bonus pools. Elite Boutique firms (e.g., Evercore, Lazard, Moelis) often pay similar or even higher total compensation, as they may allocate a larger percentage of revenue to employee bonuses. Middle-Market Boutiques may offer slightly lower bases but significant bonus potential based on deal flow. The best way to maximize earnings long-term is often to secure a role at a top-tier firm.

What Is the Career Path and Long-Term Earning Potential?

The investment banking career ladder is steep but lucrative. How long does it take to progress? A typical path is: Analyst (2-3 years) -> Associate (3 years) -> Vice President (3+ years) -> Director/Managing Director. How much can a Managing Director (MD) make? Total compensation can range from $1 million to several million dollars annually, heavily dependent on the division’s performance and the individual’s deal roster. Many bankers exit to higher-paying roles in private equity, hedge funds, or corporate development after the Analyst or Associate stage, where earning potential can further skyrocket.

What Are the Top Skills and Qualifications Needed to Maximize Salary?

To command top dollar, specific credentials are non-negotiable. Which qualifications are most valued?

-

Education: A bachelor’s degree from a top-tier university (Ivy League, etc.) is standard. An MBA from a leading business school is essential for rising beyond the Associate level.

-

Technical Skills: Proficiency in financial modeling, valuation (DCF, Comps, Precedents), and creating pitch books.

-

Soft Skills: Exceptional stamina, attention to detail, ability to work under extreme pressure, and strong client/interpersonal skills.

-

Certifications: While not always required, a Chartered Financial Analyst (CFA) designation can be beneficial, especially for research or specific product groups.

Table: Investment Banker Compensation Snapshot (2026 Estimates)

| Position Title | Typical Experience (Years) | Base Salary Range | Estimated Bonus (% of Base) | Total Compensation Range | Primary Responsibilities |

|---|---|---|---|---|---|

| Analyst | 0-3 | $100,000 – $130,000 | 50% – 100%+ | $150,000 – $260,000+ | Financial modeling, pitch book creation, due diligence, administrative support. |

| Associate | 3-6 | $150,000 – $200,000 | 80% – 120%+ | $270,000 – $440,000+ | Manages Analysts, interacts with clients, develops deal materials, more complex modeling. |

| Vice President (VP) | 6-10 | $250,000 – $350,000 | 80% – 150%+ | $450,000 – $875,000+ | Deals execution, senior client contact, manages team, key role in pitching. |

| Director / Managing Director (MD) | 10+ | $400,000 – $600,000+ | 100% – 300%+ | $1M – $3M+ | Originates deals, ultimate client relationship holder, sets strategy, oversees P&L. |

Frequently Asked Questions (FAQs)

1. Is the average salary of $54,278 accurate for Wall Street investment bankers?

No, that reported average is misleading for front-office, client-facing Investment Bankers in major financial firms. It likely aggregates data from many “banker” titles across the country. In high finance, total compensation for first-year Analysts at top firms in 2026 typically starts well above $150,000.

2. How important is the annual bonus compared to base salary?

The bonus is critically important, often constituting 50% or more of total compensation. In good years, bonuses can exceed the base salary, especially for VPs and Managing Directors. Your total pay is directly tied to market conditions and your deal performance.

3. What is the work-life balance like for this salary?

The pros and cons are extreme. The compensation is very high, but the workload is notoriously intense, with 80-100 hour weeks common for Analysts and Associates. The trade-off is significant financial reward for a period of intense career acceleration.

4. Do you need an MBA to become an Investment Banker?

Not for entry-level Analyst positions, which are filled with top undergraduate recruits. However, an MBA from a prestigious school is the standard and almost required pathway to enter at the Associate level and to progress to the senior ranks (VP and above).

5. Which industry sector within investment banking pays the most?

Historically, Mergers & Acquisitions (M&A) and Leveraged Finance are among the highest-paying sectors due to their deal-based, high-fee nature. Technology and Healthcare banking groups have also been highly lucrative in recent years, driven by strong sector activity.

6. How has compensation changed leading into 2026?

Following a slowdown in deal activity in prior years, 2026 is projected to see a rebound, which should lead to healthier bonus pools compared to 2024-2025. Firms are competing fiercely for top talent, keeping base salaries high and bonus potential significant.

7. What are the exit opportunities and how do they affect long-term earnings?

Exit opportunities are a major draw. After 2-3 years as an Analyst, many move into Private Equity or Hedge Funds, where the earning potential can be even higher due to a share of fund profits (carried interest). This makes the initial banking stint a highly valuable career investment.

Disclaimer: The salary data, compensation ranges, and career information provided in this article are estimates based on market research, industry reports, and aggregated data as of 2026. Actual compensation for Investment Bankers can vary widely based on the individual’s specific employer, performance, geographic location, market conditions, and division. This information is for general guidance only and should not be considered a guarantee of earnings.

Keywords: investment banker salary, average salary investment banker, Wall Street pay, investment banker salary 2026, finance salary, banker compensation, investment banking analyst salary, vice president investment banking salary, bonus structure, investment banking jobs