Credit Analyst Average Salary in USA, 2026

Credit Analyst salaries in the United States represent a key benchmark for finance and banking professionals. As of 2026, what is the earning potential for those who assess creditworthiness and manage financial risk? This comprehensive guide provides detailed salary data, state-by-state breakdowns, and analysis of the factors that influence pay, from entry-level to senior positions. Understanding this landscape is essential for career planning, negotiation, and navigating the competitive financial job market.

What Is the Average Credit Analyst Salary in the United States for 2026?

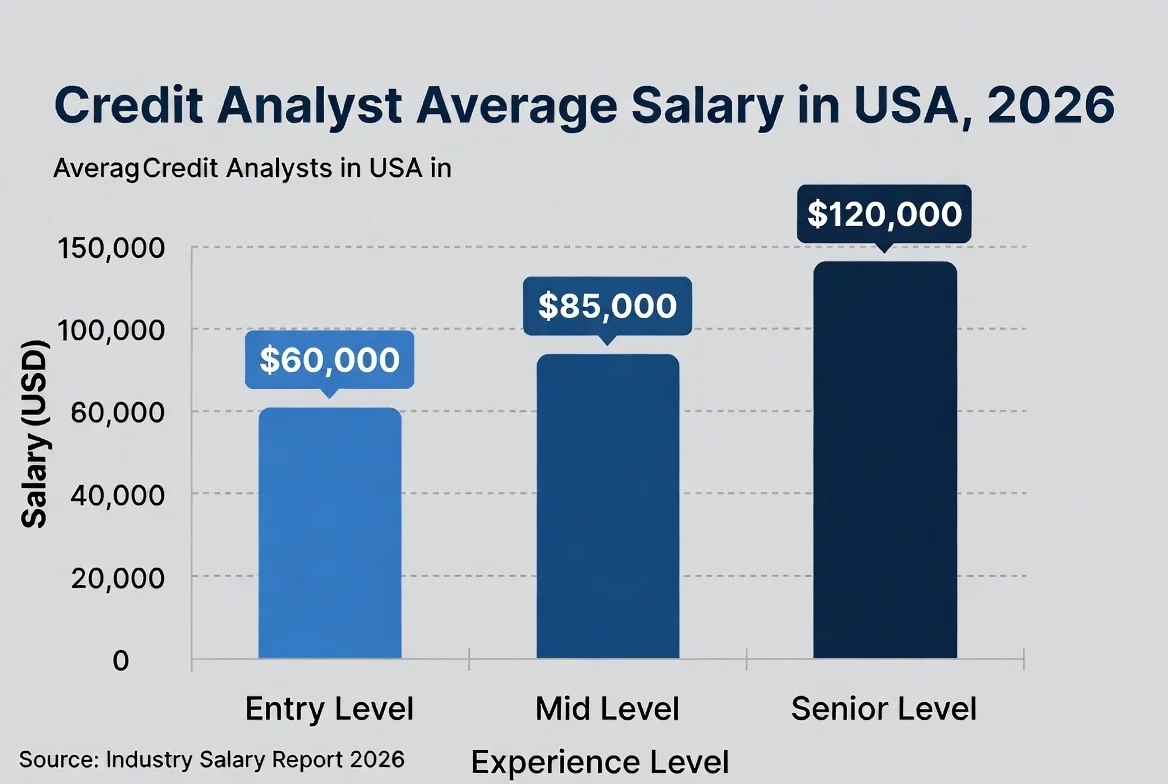

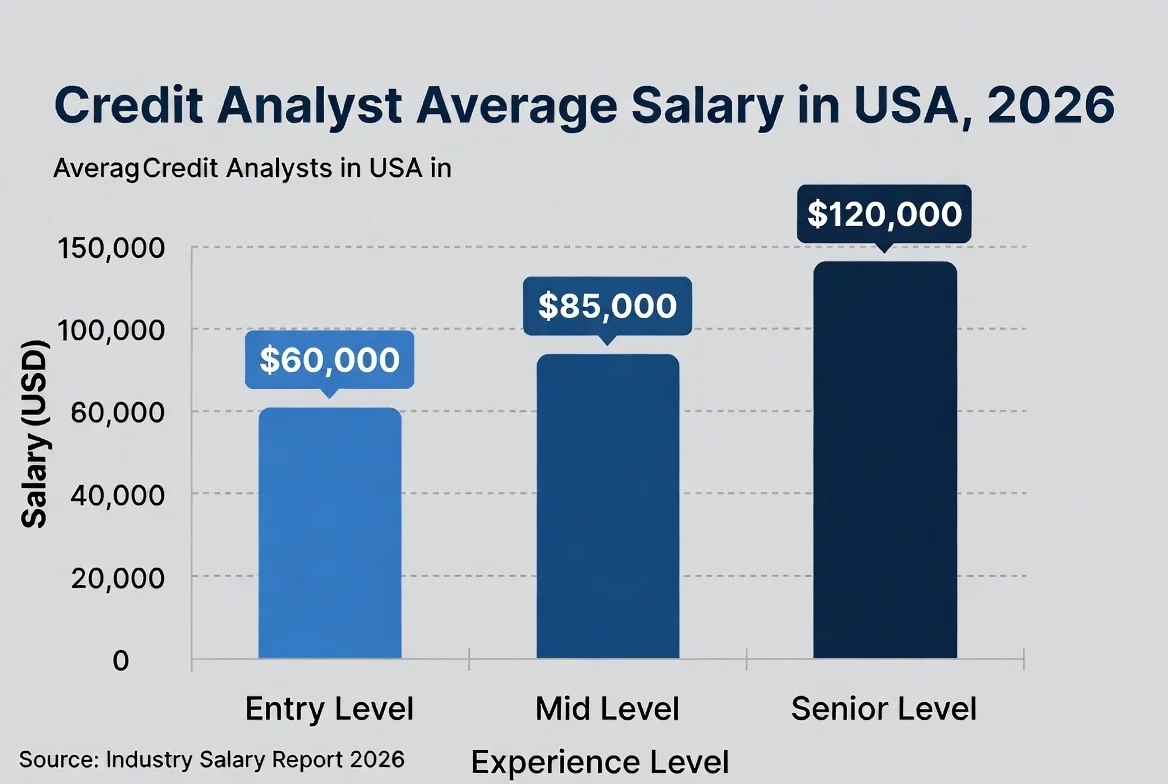

How much can a Credit Analyst expect to earn annually? The national average salary for a Credit Analyst in the United States in 2026 is $90,000 per year, which translates to an hourly rate of approximately $45.55. This median figure is based on extensive market data and serves as a central reference point. What is the difference between the median, entry-level, and experienced professional pay? Entry-level positions typically start around $60,751 per year, reflecting the initial learning curve in risk assessment and financial analysis. Conversely, the most experienced and specialized Credit Analysts can earn up to $128,300 per year. This range highlights the significant impact of experience, industry, and geographic location on earning potential.

Which States Offer the Highest and Lowest Salaries for Credit Analysts?

Where should a Credit Analyst look to maximize their income? Salaries vary dramatically by state due to cost of living, concentration of financial institutions, and local economic conditions. Which states are the top payers? The data for 2026 shows Virginia leading with an average of $100,485, followed closely by Maryland at $99,425. Hawaii ($95,000), California ($93,344), and New York ($93,214) round out the top five, all benefiting from major financial hubs and higher costs of living.

What are the pros and cons of working in a high-salary state? While the gross pay is higher, it is often offset by significantly higher living expenses, particularly in housing and taxes. How much less do Credit Analysts make in lower-paying states? At the other end of the spectrum, states like South Dakota ($67,600), Montana ($68,301), and Louisiana ($69,101) offer lower average salaries, which may align with a more affordable cost of living. The choice often depends on personal lifestyle preferences and career stage.

What Factors Most Influence a Credit Analyst’s Salary?

Beyond location, several key variables determine where a Credit Analyst falls within the broad salary range. What are the best ways to command a higher salary?

-

Experience and Seniority: This is the most significant driver. A senior analyst with 8+ years of experience managing complex portfolios will earn substantially more than an entry-level analyst.

-

Industry and Employer Type: Working for a large investment bank, asset management firm, or major corporate treasury typically pays more than a role at a community bank or credit union.

-

Education and Certifications: A Master’s in Finance, Economics, or Business Administration (MBA) can boost salary prospects. Professional certifications like the Chartered Financial Analyst (CFA) or Credit Risk Certification (CRC) are highly valued and often linked to pay increases.

-

Specialized Skills: Expertise in financial modeling, specific industry analysis (e.g., commercial real estate, leveraged finance), or proficiency with advanced risk software (Moody’s, S&P) commands a premium.

How can you strategically develop these factors? Pursuing targeted certifications and seeking roles in high-margin industries are proven paths to higher earnings.

How Does Credit Analyst Pay Compare to Related Finance Roles?

What is the difference between a Credit Analyst’s salary and that of similar financial positions? Understanding this hierarchy is crucial for career trajectory planning.

| Related Job Title | Average Salary (2026) | Primary Focus | Typical Career Path From Credit Analyst |

|---|---|---|---|

| Controller | $117,586 | Overseeing all accounting operations | Senior Finance Management |

| Underwriter | $105,000 | Risk assessment for insurance policies | Parallel move within risk |

| Finance / Accounting Manager | $93,284 | Managing finance teams & reporting | Direct promotion |

| Risk Analyst | $92,200 | Broad risk management (operational, market) | Specialization move |

| Financial Analyst | $84,100 | Broader corporate finance & budgeting | Lateral or entry-level role |

| Bookkeeper | $54,540 | Recording financial transactions | Not typical |

The table shows that a Credit Analyst role is competitively positioned, often serving as a springboard to higher-paying management or specialized risk positions.

What Is the Career Outlook and Growth Potential for Credit Analysts?

Is it worth pursuing a career as a Credit Analyst? The role remains fundamental to the banking and finance sector. How fast is the field growing? While automation handles more routine tasks, the demand for analysts with strong judgment, complex problem-solving skills, and commercial acumen is steady. Growth is tied to economic cycles and regulatory environments. What are the top advancement opportunities? Common progression paths include moving to Senior Credit Analyst, Credit Manager, Portfolio Manager, or transitioning into Relationship Management or Investment Banking roles. The analytical foundation is highly transferable.

What Are the Essential Skills and Qualifications Needed in 2026?

To secure a role at the higher end of the salary scale, specific competencies are non-negotiable. Which skills are employers prioritizing in 2026?

-

Technical Skills: Advanced Excel, financial statement analysis, ratio analysis, cash flow modeling, and familiarity with CRM and risk database software.

-

Analytical Skills: Keen attention to detail, ability to interpret complex financial data, and strong research capabilities.

-

Soft Skills: Excellent written and verbal communication (for writing detailed reports), sound judgment, decision-making ability, and integrity.

-

Education: A bachelor’s degree in finance, accounting, economics, or business is the minimum requirement for most positions.

How Can You Negotiate a Competitive Credit Analyst Salary?

When offered a position, how should you approach negotiation? First, research the market rate for your specific location, experience level, and industry using data like that provided here. Second, quantify your value by highlighting specific achievements, such as “managed a portfolio of X size” or “reduced delinquency rates by Y%.” Third, consider the entire compensation package, including bonuses, benefits, retirement plans, and professional development allowances. How many negotiation rounds are typical? Be prepared for a respectful dialogue, often concluding within one or two discussions.

Frequently Asked Questions (FAQs)

1. What is the entry-level salary for a Credit Analyst?

As of 2026, entry-level Credit Analyst positions in the United States typically start between $60,751 and $75,000 per year, depending on the employer’s location and size. Graduates with relevant internships or certifications may start at the higher end of this range.

2. Do Credit Analysts receive bonuses?

Yes, bonuses are a common part of total compensation, especially in commercial banking and investment firms. Bonuses can range from 5% to 20% or more of the base salary, tied to individual performance, team goals, and company profitability.

3. What industry pays Credit Analysts the most?

The highest salaries are typically found in investment banking, asset management, private equity, and at large commercial banks dealing with complex corporate clients. Specialized industries like aerospace or technology finance may also offer premium pay.

4. How does remote work affect Credit Analyst salaries?

While remote opportunities have increased, salaries are often still anchored to the company’s office location or the employee’s home geographic zone if it’s a national pay scale. Fully remote roles may offer competitive national averages but not the peak salaries of major financial centers.

5. What is the most important certification for a Credit Analyst?

The Chartered Financial Analyst (CFA) designation is widely regarded as the gold standard and can significantly enhance credibility and earning potential. The Credit Risk Certification (CRC) from the Risk Management Association is another highly respected credential specific to the field.

6. Is a master’s degree required to become a Credit Analyst?

No, a bachelor’s degree is typically sufficient for entry-level roles. However, a Master’s in Finance or an MBA can accelerate career advancement, open doors to more competitive employers, and is often expected for senior-level positions.

7. What is the job market outlook for Credit Analysts in 2026?

The outlook is stable. While foundational analysis is always needed, the role is evolving to require more strategic thinking and technology-augmented skills. Professionals who embrace data analytics tools and deepen their industry expertise will find the strongest opportunities.

Disclaimer: The salary data, figures, and career advice provided in this article are for general informational purposes only. They are based on aggregated market data for 2026 and should be used as a guide. Actual salaries can vary widely based on individual qualifications, specific employer, exact location, economic conditions, and negotiation. The user is solely responsible for their career decisions and should conduct their own research when making employment choices.

Keywords: credit analyst average salary, credit analyst salary 2026, credit analyst jobs, finance salaries, credit risk analyst, entry-level credit analyst, credit analyst certification, salary by state, financial analyst vs credit analyst, credit analyst career path