Insurance Adjuster Salary in the USA for 2026

Insurance Adjuster salaries in the United States are a key metric for professionals navigating the claims and risk management industry. What factors determine an adjuster’s earning potential, and how can experience, location, and specialization dramatically influence your annual income? This comprehensive 2026 analysis provides a detailed breakdown of national and state-level salary data, explores the key differences between adjuster roles, and outlines the best ways to advance your career and maximize your compensation in this critical field.

What Is the National Average Salary for an Insurance Adjuster in 2026?

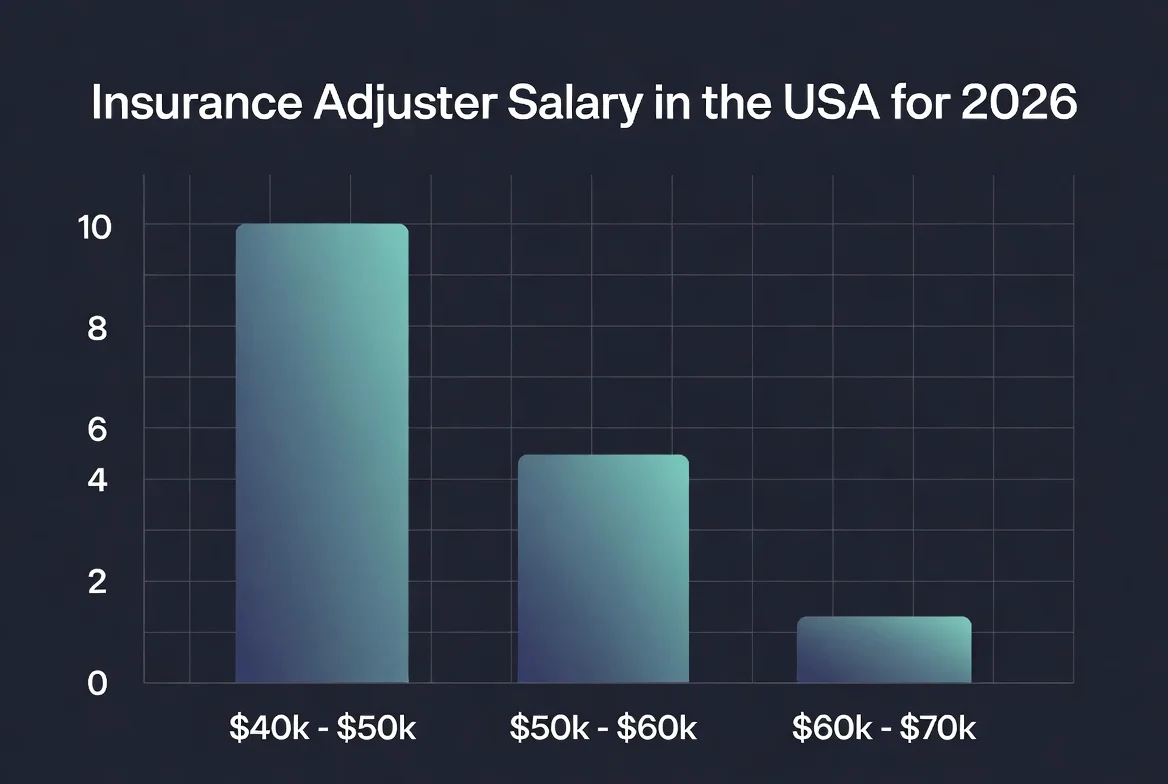

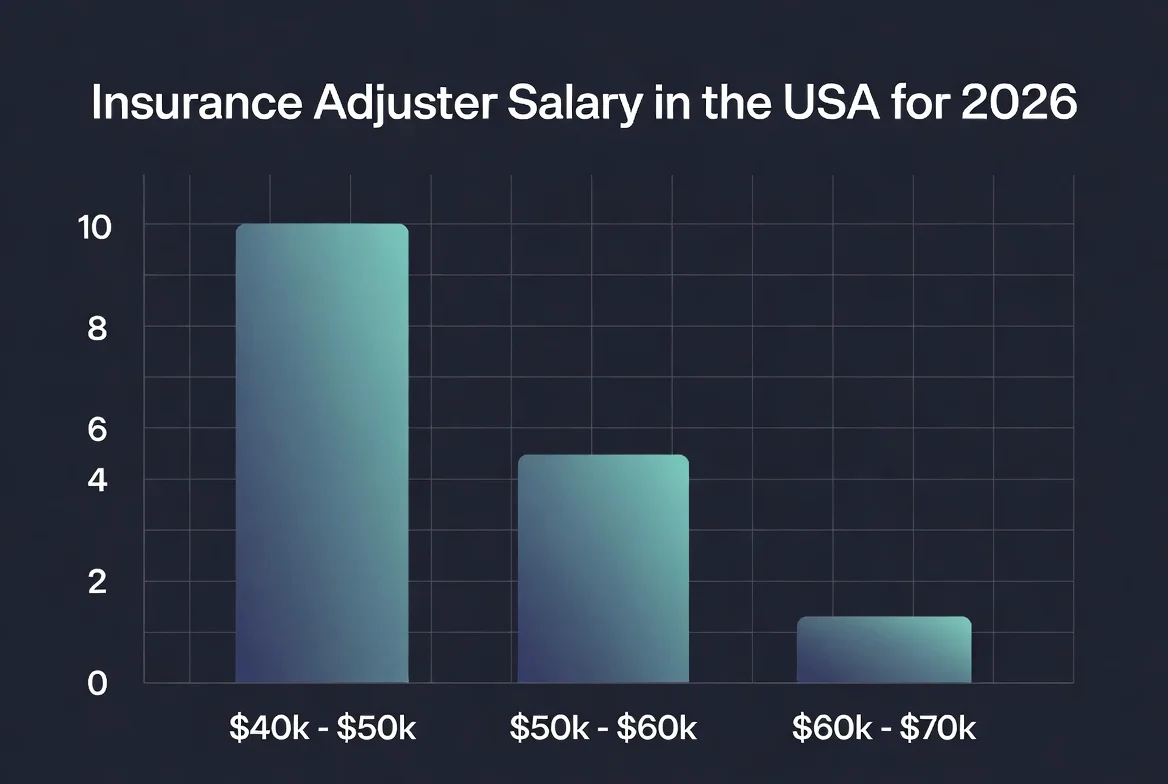

How much can you expect to earn as an Insurance Adjuster in the current market? Based on extensive aggregated data, the average national salary for an Insurance Adjuster in the United States in 2026 is $69,550 per year. This figure translates to an hourly wage of approximately $35.20. How much variation exists within this field? Entry-level positions, often requiring less than one year of experience, typically start around $48,113 per year. In contrast, the top tier of highly experienced adjusters with specialized skills or certifications can earn upwards of $110,750 annually. This wide range highlights the significant impact of career progression on earning potential.

Which States Offer the Highest Salaries for Insurance Adjusters?

Geographic location is one of the most influential factors on an adjuster’s salary. Where should you look for the highest compensation? Salaries can fluctuate dramatically by state due to cost of living, demand for adjusters (often driven by weather events and population density), and local industry hubs. States with major metropolitan areas and high insurance activity, such as California, New York, and Texas, frequently top the list. What is the difference between working in a high-cost coastal state versus the Midwest? An adjuster in a state like Florida, with its high exposure to property claims, may command a different premium than one in Illinois. To maximize your salary, researching state-specific data is one of the top strategies for job seekers and professionals considering relocation.

How Do Experience and Specialization Affect an Adjuster’s Pay?

How fast does an Insurance Adjuster’s salary grow with experience? The progression from an entry-level claims trainee to a senior-level adjuster can see salary increases of 50% or more. The first five years are crucial for building foundational skills in investigation, evaluation, and negotiation. Which specializations command the highest premiums? Adjusters who specialize in complex lines such as Commercial Liability, Workers’ Compensation, or Catastrophe (CAT) Adjusting often earn significantly more than those handling standard auto or property claims. CAT adjusters, in particular, are deployed to disaster areas and are compensated with high daily rates and overtime, making it one of the best ways to boost annual income rapidly, though it requires extensive travel.

What Are the Pros and Cons of a Career as an Insurance Adjuster?

Is it worth pursuing a career as an Insurance Adjuster? Understanding the pros and cons is essential for making an informed decision.

Pros:

-

Strong Earning Potential: With experience and specialization, salaries can be very competitive, exceeding $110,000 for top performers.

-

Job Stability: Insurance is a perennial industry; claims will always need to be assessed and settled.

-

Variety and Autonomy: The work is rarely monotonous, and many adjusters, especially field adjusters, enjoy a high degree of independence.

-

Clear Career Path: Defined pathways exist to senior adjuster, supervisor, and managerial roles.

Cons:

-

High-Stress Situations: Dealing with claimants after a loss can be emotionally challenging and confrontational.

-

Workload Fluctuations: Following major weather events, workloads can become overwhelming, leading to long hours.

-

Administrative Burden: A significant portion of the job involves detailed documentation, reporting, and compliance.

-

Licensing Requirements: Most states require adjusters to be licensed, which involves pre-licensing education and exams.

What Is the Salary Comparison Between Adjuster Roles and Related Positions?

To understand an Insurance Adjuster’s market value, it’s helpful to compare it to related roles within the insurance ecosystem. How does an adjuster’s pay stack up against other claims professionals?

| Related Job Title | Average Annual Salary (2026) | Primary Focus | Typical Requirement Difference |

|---|---|---|---|

| Claims Manager | $93,284 | Oversees adjusters and the claims department process. | Management experience, broader strategic focus. |

| Claims Analyst | $90,000 | Analyzes claims data for trends, fraud, and process improvement. | Strong analytical and data skills. |

| Claim Examiner | $86,186 | Reviews complex or high-value claims for coverage and settlement accuracy. | Deep technical policy knowledge, often a senior role. |

| Claim Adjuster | $79,700 | Often used interchangeably with Insurance Adjuster; handles claim investigation and settlement. | Similar core skills; title variance by company. |

| Insurance Adjuster | $69,550 | Investigates, evaluates, and settles insurance claims. | State license, strong interpersonal skills. |

This table shows that while the core adjusting role offers a solid median salary, advancement into analytical, examinational, or managerial positions is a key way to increase earnings substantially.

How Can You Increase Your Salary as an Insurance Adjuster?

What are the best ways to boost your income in this profession? Beyond gaining years of experience, proactive career management is crucial.

-

Obtain Key Certifications: Designations like the Chartered Property Casualty Underwriter (CPCU), Associate in Claims (AIC), or Certified Claims Professional (CCP) are highly respected and can lead to promotions and pay raises.

-

Specialize in High-Value Niches: Moving into complex commercial lines, cyber liability, or professional liability insurance often comes with higher compensation due to the expertise required.

-

Develop Technical Proficiency: Mastery of claims software, estimating platforms like Xactimate, and data analytics tools makes you more efficient and valuable.

-

Pursue Leadership Roles: Transitioning from handling an individual caseload to supervising a team is a proven path to a higher salary bracket, as seen in the Claims Manager average.

-

Consider Independent Adjusting: Independent Adjusters (IAs) who work as contractors for multiple firms can often achieve higher per-claim fees, though they lack employee benefits and face income variability.

How long does it typically take to see a significant salary jump? Most professionals see their most substantial increases within the first 5-10 years as they move from junior to senior levels and acquire specializations.

What Is the Future Job Outlook for Insurance Adjusters?

Should you be optimistic about the long-term prospects in this career? The demand for Insurance Adjusters is expected to remain steady. How many jobs are projected? While automation and AI are streamlining some tasks, the need for human judgment, complex investigation, and empathetic customer interaction in claims settlement ensures ongoing opportunities. Furthermore, climate change is increasing the frequency and severity of weather-related claims, potentially driving demand for catastrophe adjusters. Professionals who combine technical adjuster skills with digital literacy and data analysis will be best positioned for the future, likely commanding the highest salaries.

Frequently Asked Questions (FAQs)

1. What is the difference between a Claims Adjuster and an Insurance Adjuster?

In practical terms, these titles are often used interchangeably within the industry. Both roles involve investigating, evaluating, and settling insurance claims. Some companies may use “Claims Adjuster” for entry-level roles and “Insurance Adjuster” for more experienced staff, but there is no standardized distinction.

2. Do I need a license to become an Insurance Adjuster?

Yes, in most states. Licensing requirements vary by state but generally involve completing pre-licensing education, passing a state exam, and undergoing a background check. Some states have reciprocity agreements. It is essential to check the specific requirements for the state in which you plan to work.

3. How much does an Independent Insurance Adjuster make?

Independent adjusters are not salaried employees but work on a fee-schedule basis. Their income can be highly variable, often depending on the number and type of claims they handle. During busy catastrophe seasons, a skilled independent adjuster can earn well over $100,000, but income may be inconsistent during slower periods.

4. What skills are most important for a high-earning Insurance Adjuster?

Top-earning adjusters typically excel in investigation and analysis, negotiation, detailed documentation, and customer service. Specialized technical knowledge (e.g., in construction, auto repair, or healthcare) and proficiency with claims management software are also critical for handling complex, high-value claims.

5. Is the salary data for 2026 adjusted for inflation?

The salary figures presented are market averages projected for the 2026 calendar year, reflecting anticipated industry compensation trends. They are nominal figures. When comparing to past years’ salaries, it is important to consider the effects of inflation on purchasing power.

Disclaimer: The salary data, figures, and career advice presented in this article are for general informational purposes only. They are based on aggregated market data and projections for 2026. Actual salaries for Insurance Adjusters can vary widely based on individual factors such as specific employer, exact job title, years of specialized experience, educational background, certifications, geographic location within a state, and prevailing economic conditions. This information should not be solely relied upon for financial or career decisions.

Keywords: insurance adjuster salary, claims adjuster salary 2026, average adjuster salary USA, how much do insurance adjusters make, independent adjuster pay, claims adjuster jobs, insurance career salary, adjuster license, catastrophe adjuster salary, claims manager salary