Economist Average Salary in USA, 2026

Economist salaries in the United States are a direct reflection of the critical role these professionals play in analyzing data, forecasting trends, and informing high-stakes decisions across both the public and private sectors. As of 2026, what is the true earning potential for an economist? How much can you expect to make at the entry-level versus as a seasoned expert, and which factors—from geographic location to industry specialization—most significantly impact pay? This comprehensive analysis provides the definitive breakdown of economist salaries, offering data-driven insights for students, job seekers, and professionals aiming to benchmark their compensation or plan their career trajectory in this influential field.

What Is the National Average Salary for an Economist in 2026?

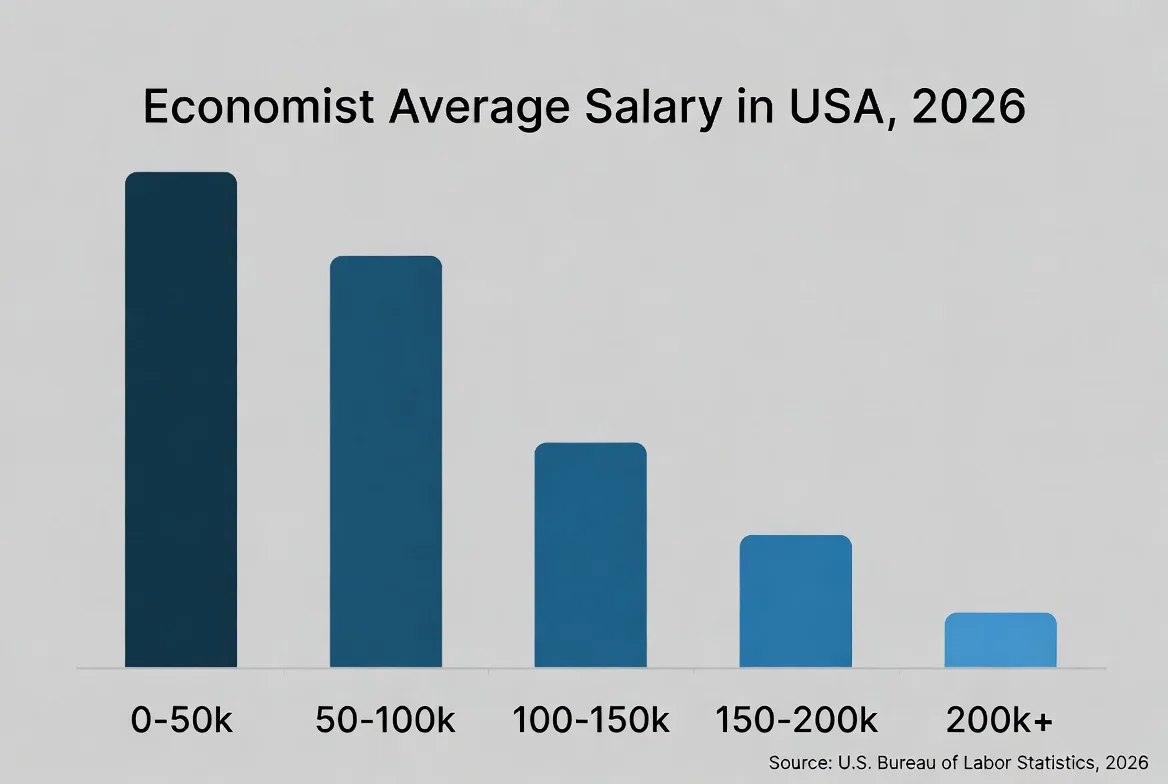

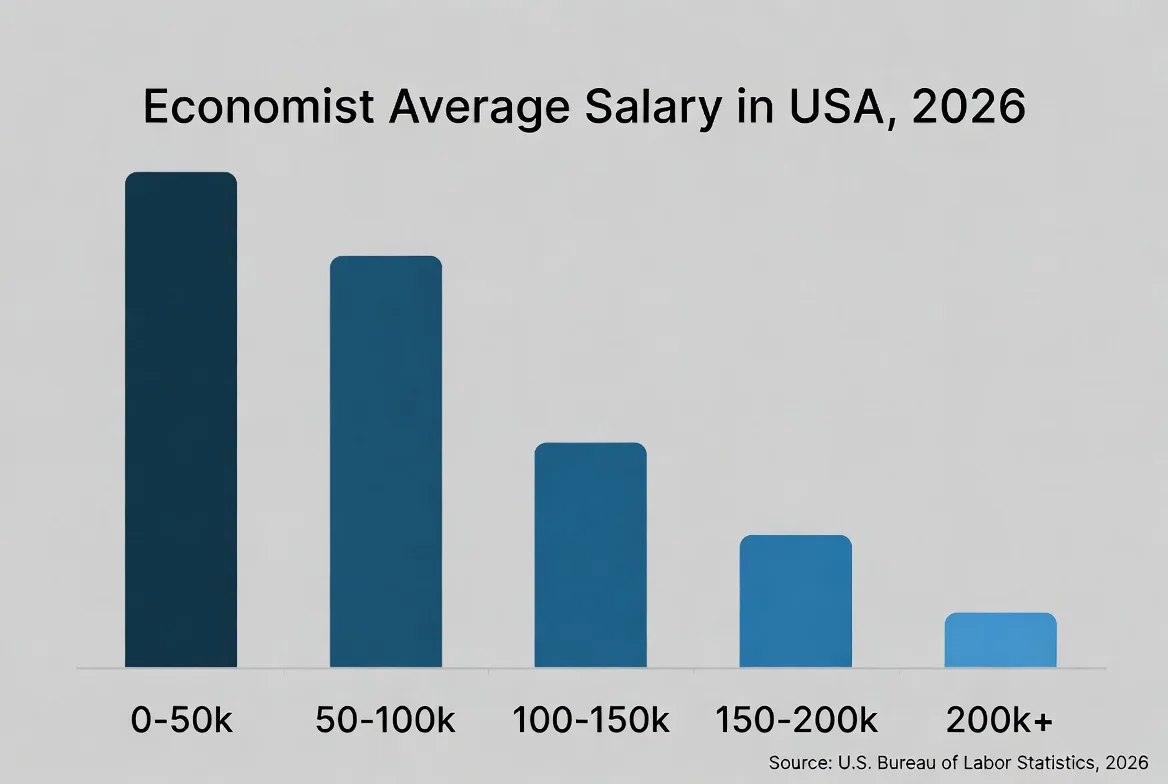

What does the typical economist earn annually in the current economic climate? According to aggregated salary data from 2026, the national average salary for an Economist in the United States is $109,200 per year. When broken down, this equates to an hourly wage of approximately $55.26. This figure represents the median point, meaning half of all economists earn more than this amount, and half earn less. How much variation exists around this average? Entry-level positions, often requiring a Master’s degree and limited experience, start at an average of $81,250 per year. In contrast, the top tier of experienced economists, particularly those in senior roles, in management, or with specialized expertise, can command salaries upwards of $185,215 per year. This range highlights the significant financial growth potential within the economics profession.

Which Top-Paying States Offer the Highest Salaries for Economists?

Where you work is one of the most powerful determinants of your salary. What is the difference between salaries in a government hub like Washington D.C. versus the tech centers of California? Geographic salary variation is substantial for economists, largely driven by the concentration of high-paying employers like federal agencies, financial institutions, and corporate headquarters.

| State | Average Annual Salary (2026) | Key Drivers & Employment Hubs |

|---|---|---|

| Washington, D.C. | $201,000 | Federal government (FED, SEC, DOJ), international institutions, think tanks. |

| Florida | $147,500 | Finance sector, tourism economics, growing corporate analytics roles. |

| California | $142,600 | Tech industry economics (FAANG), entertainment economics, high cost of living. |

| Virginia | $141,214 | Proximity to D.C., defense contractors, federal consulting firms. |

| Massachusetts | $140,828 | Academic research, biotechnology and healthcare economics, financial services. |

How can you leverage this information? While a high salary is attractive, it’s crucial to factor in the local cost of living. A salary in Washington D.C. may be offset by housing costs, whereas a slightly lower salary in a state with a lower cost of living may provide greater disposable income.

What Are the Key Factors That Influence an Economist’s Salary?

Beyond location, multiple variables converge to determine individual compensation. Which factors carry the most weight? First and foremost is education. A Bachelor’s degree may suffice for some analyst roles, but a Master’s degree (MA/MS) is often considered the entry-standard for the “Economist” title, and a Ph.D. can unlock roles in advanced research, academia, and top-tier federal positions, significantly boosting earning potential.

Second, industry and sector create major pay disparities. What is the best way to maximize salary? Economists in private sector consulting (management, economic consulting) and finance (investment banking, quantitative analysis) typically out-earn their counterparts in academia or local government. However, federal government roles, while sometimes offering lower base pay, provide exceptional job security, benefits, and clear advancement tracks.

Third, specialized skills are highly monetizable. Should you learn specific programming languages? Proficiency in statistical software (R, Stata) and programming languages (Python, SQL) for data analysis and econometric modeling is increasingly mandatory and can command a premium. Expertise in niche areas like behavioral economics, machine learning applications, or international trade law also adds significant value.

How Does Experience Directly Translate to Salary Growth for Economists?

Experience is the engine of salary progression in economics. How much more can you earn with each career milestone? The trajectory is steep. An Entry-Level Economist (0-3 years) with a Master’s degree can expect to start in the $81,250 – $95,000 range, often in analyst or associate roles. A Mid-Career Economist (4-9 years) typically sees salaries jump into the $100,000 – $140,000 range, moving into senior analyst, project lead, or assistant professor positions. Senior-Level Economists (10+ years) and those in leadership roles (Chief Economist, Director of Research) regularly earn $150,000 to well over $185,215, with top earners in finance or as partners at consulting firms exceeding $250,000.

What Are the Related Job Titles and Their Salaries?

Understanding the broader job market context is crucial. How does the core “Economist” role compare to related positions?

Senior Economist commands an average of $119,850, reflecting added responsibility for research design, team leadership, and client/stakeholder management.

Professor of Economics averages $101,250, though this varies widely by institution prestige (e.g., Ivy League vs. state college) and includes compensation for teaching, research, and publication.

Roles like Medical Economics Consultant ($94,536) showcase the value of applying economic principles to specialized fields like healthcare.

What Is the Job Outlook and Future Demand for Economists?

Is it worth pursuing a career in economics in 2026 and beyond? The outlook remains strong. The U.S. Bureau of Labor Statistics projects steady demand, driven by the increasing need for data analysis to guide business strategy and public policy. Which sectors are growing fastest? Demand is particularly robust in healthcare, technology, and environmental sustainability, where economists are needed to model costs, assess market impacts, and evaluate regulations. The proliferation of “big data” has also created new roles for economists who can interpret complex datasets, ensuring the profession evolves alongside technological change.

Frequently Asked Questions (FAQs)

1. What is the difference between an Economist and a Financial Analyst?

While both roles analyze data, an Economist typically focuses on broader systems—studying market trends, policy impacts, and macroeconomic indicators to build predictive models and advise on long-term strategy. A Financial Analyst usually focuses on a specific company, industry, or investment portfolio, analyzing financial statements and performance to guide immediate business decisions or investment recommendations. The economist’s scope is generally wider and more theoretical.

2. How much would I take home after taxes on a $109,200 salary?

Your net income depends on your state of residence, filing status, and deductions. As a very general estimate, a single filer in a state with moderate taxes might take home approximately $75,000 to $82,000 annually after federal and state taxes. Using a precise tax calculator with your personal details is essential for an accurate figure.

3. Do I need a Ph.D. to become a high-earning Economist?

Not necessarily. A Ph.D. is essential for tenure-track academic positions and some advanced research roles in federal government (e.g., the Federal Reserve) or think tanks. However, many high-earning roles in private-sector consulting, finance, and corporate strategy are accessible with a Master’s degree, especially when coupled with relevant experience and technical skills.

4. Which skills are most in-demand for Economists in 2026?

Beyond core econometric knowledge, technical skills are paramount: advanced proficiency in Python or R for data analysis and machine learning, SQL for database management, and experience with data visualization tools (Tableau, Power BI). Soft skills like communicating complex findings to non-experts and policy writing are equally critical for impact and career advancement.

5. Are economist salaries keeping pace with inflation in 2026?

Salaries in specialized, in-demand fields like economics have generally shown resilience. The 2026 average salary reflects adjustments for the economic conditions of the preceding years. However, individual compensation growth depends on sector performance, employer policies, and the economist’s ability to align their skills with emerging market needs, such as climate economics or AI impact analysis.

Disclaimer: The salary data, figures, and career information presented in this article are based on aggregated sources and market surveys for the year 2026. They are intended for general informational and guidance purposes only. Actual compensation can vary significantly based on individual qualifications, specific employer, negotiation, economic conditions, and unanticipated market changes. The user is solely responsible for their career and financial decisions.

Keywords: economist average salary, economist salary USA 2026, how much does an economist make, economist jobs, senior economist salary, economist career path, economics degree jobs, factors affecting economist salary, economist vs financial analyst, economist job outlook